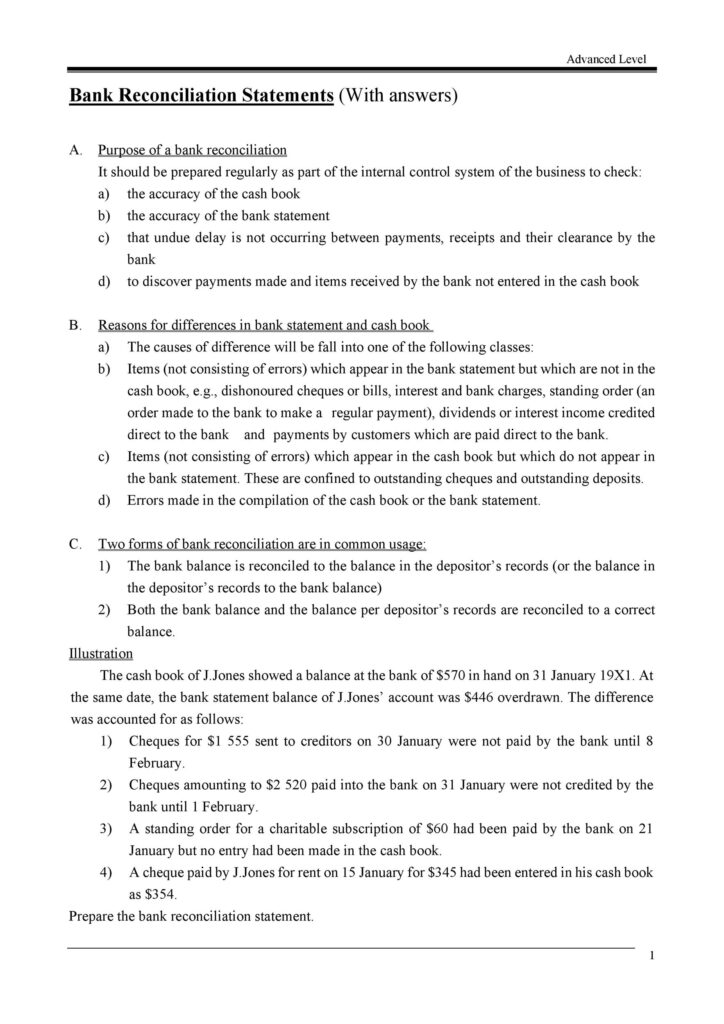

A Bank reconciliation is definitely a process performed by a business to guarantee that the records (check register, a general ledger account, balance sheet, etc.) are appropriate. This is completed by analyzing the provider’s documented portions with most of the quantities proven upon the bank statement. Any kind of difference ought to be validated. When right now there are basically no unusual distinctions, accountants suggest that the bank statement proceeds to end up being reconciled

This Bank reconciliation will allow you to monitor any exceptional checks and deposits to be able to figure almost all of them into the Balance in your checkbook and never end up considering you convey even more money than you actually perform. Simply by monitoring every single transaction in this method, you are able to keep a far nearer vision upon your spending habits, which can make it easier for you to arranged up and keep a budget intended for your house.

Most people discover that in the event that they perform not consider time to reconcile their particular bank account h each month, they complete up more than creating their particular account t, which can end up being a lot of money in overdraft charges and poor check costs.

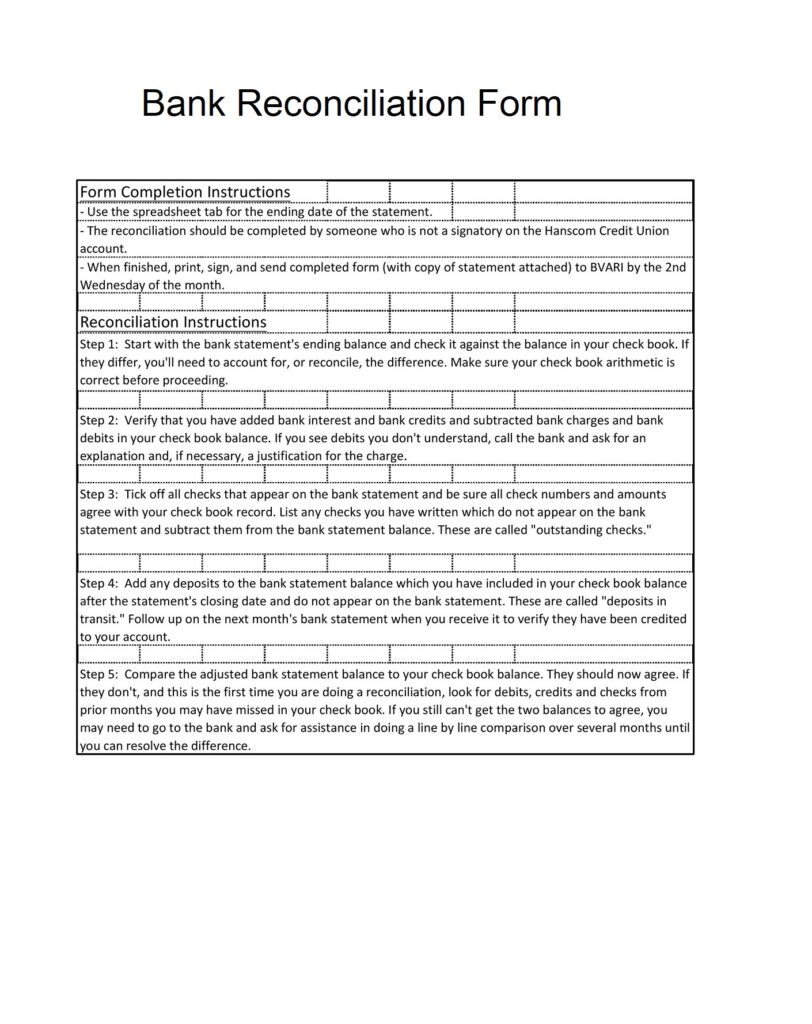

After you have this bank reconciliation you will possess to consider the period to reconcile your checkbook mainly well because the Bank Statement to make sure that both figures match. The greatest way to do that is simply by using a bank reconciliation template that may help you to assess the two units of numbers.

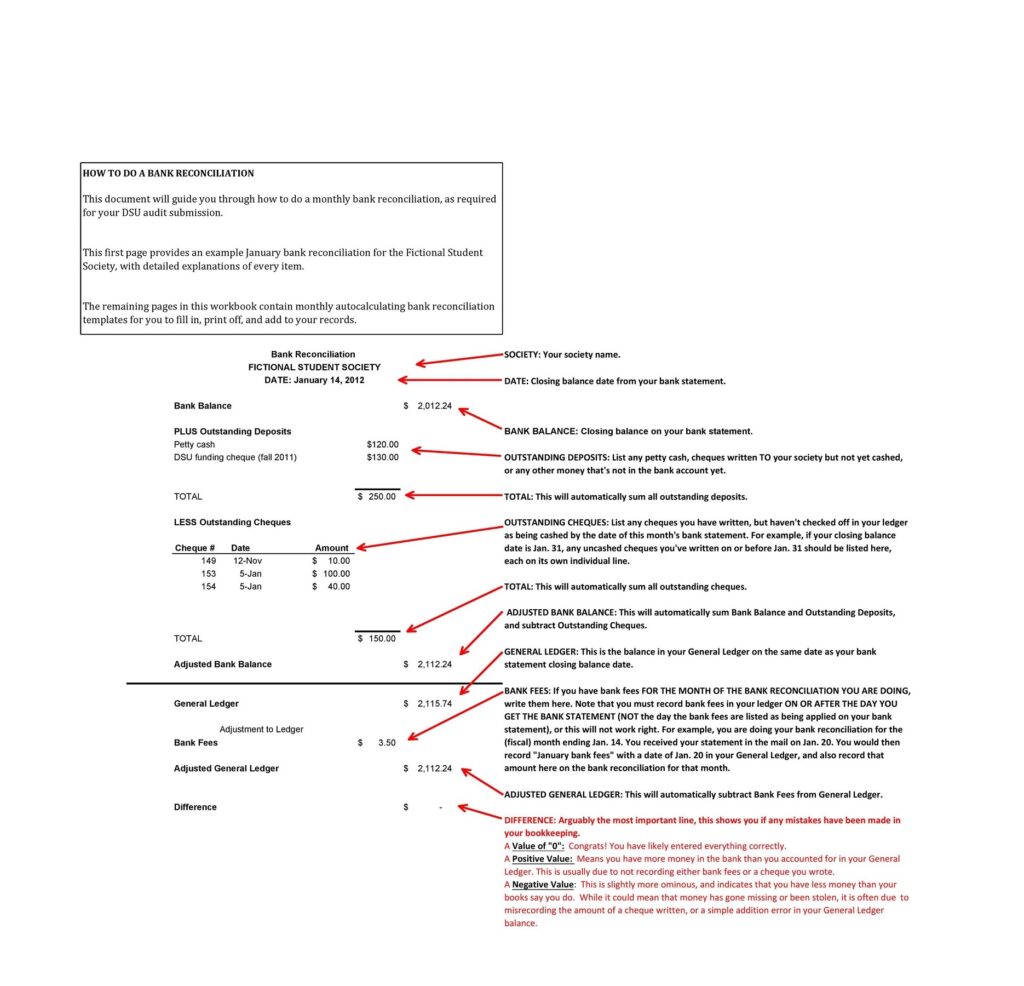

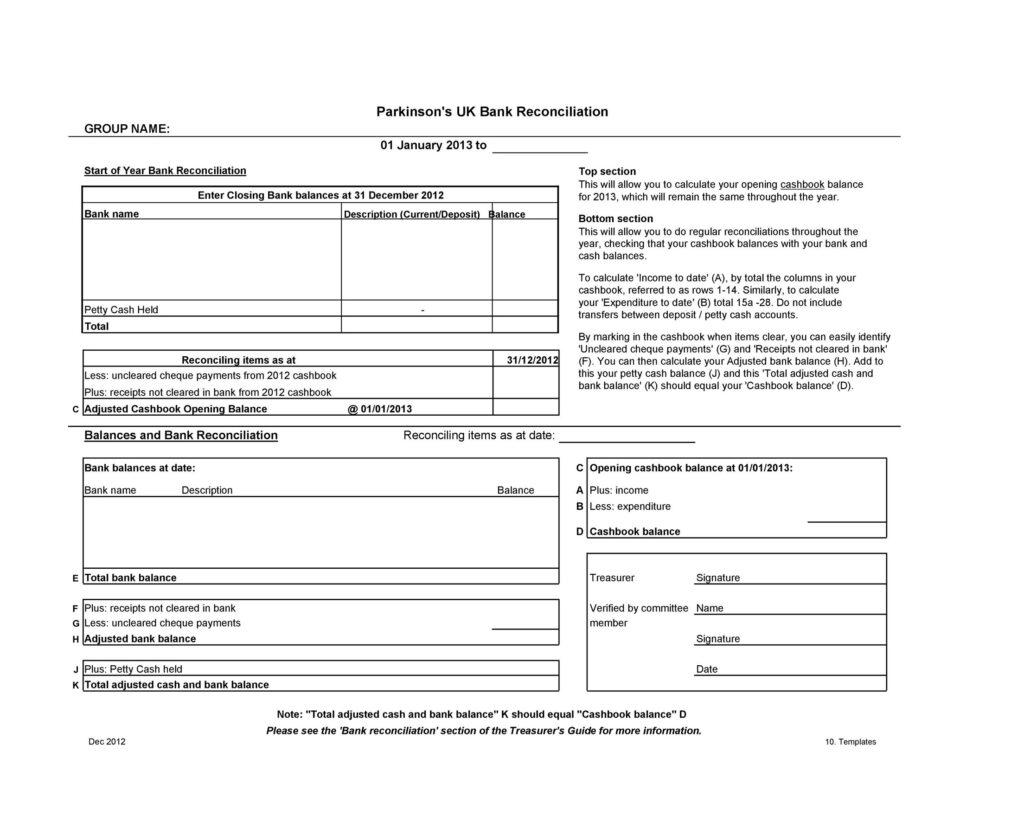

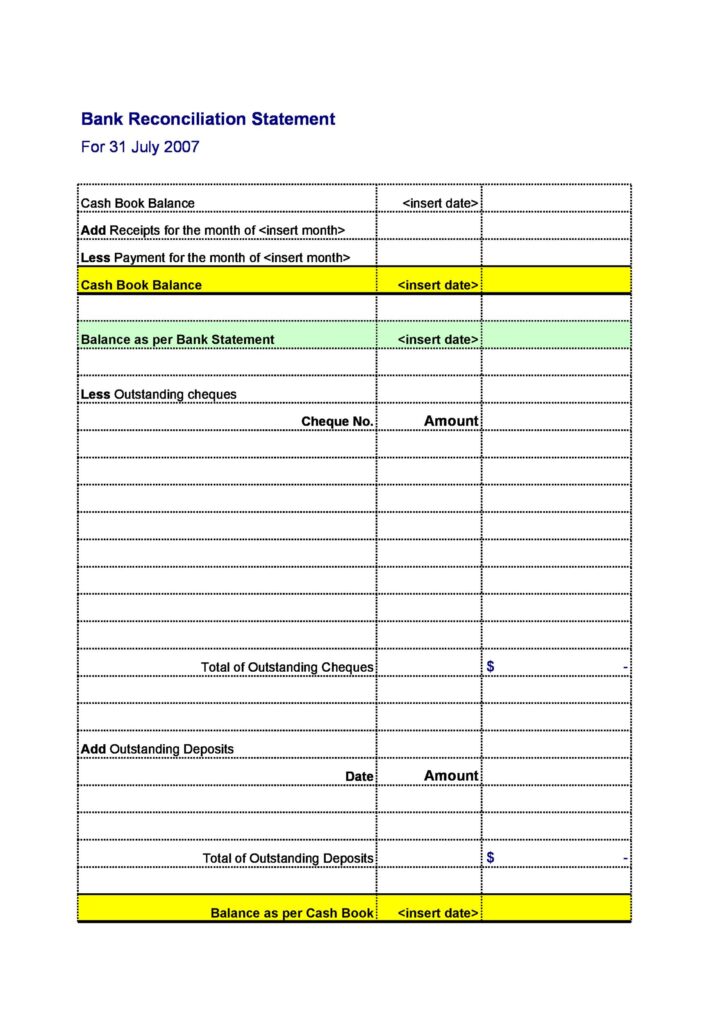

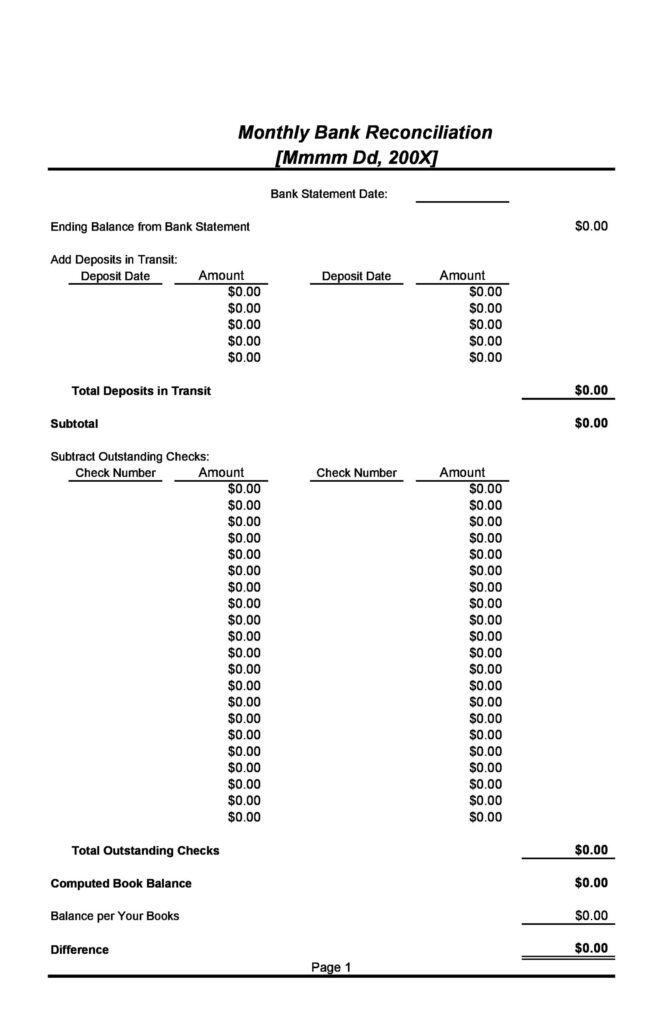

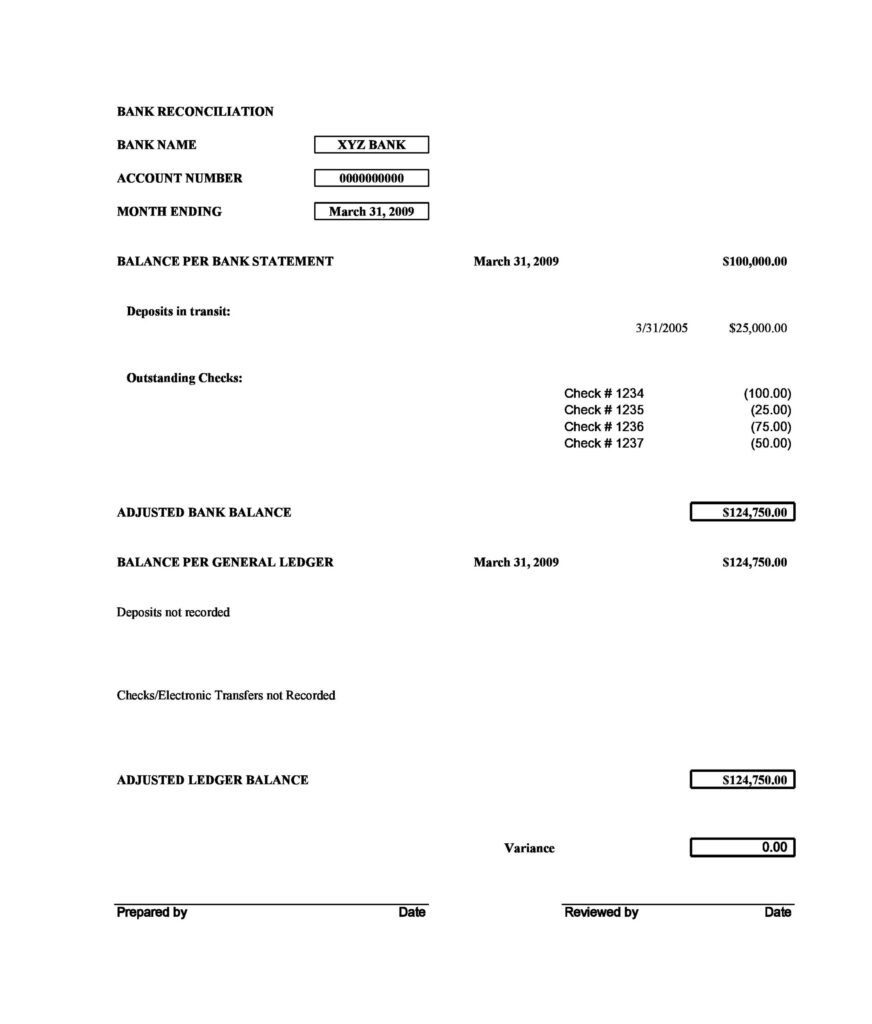

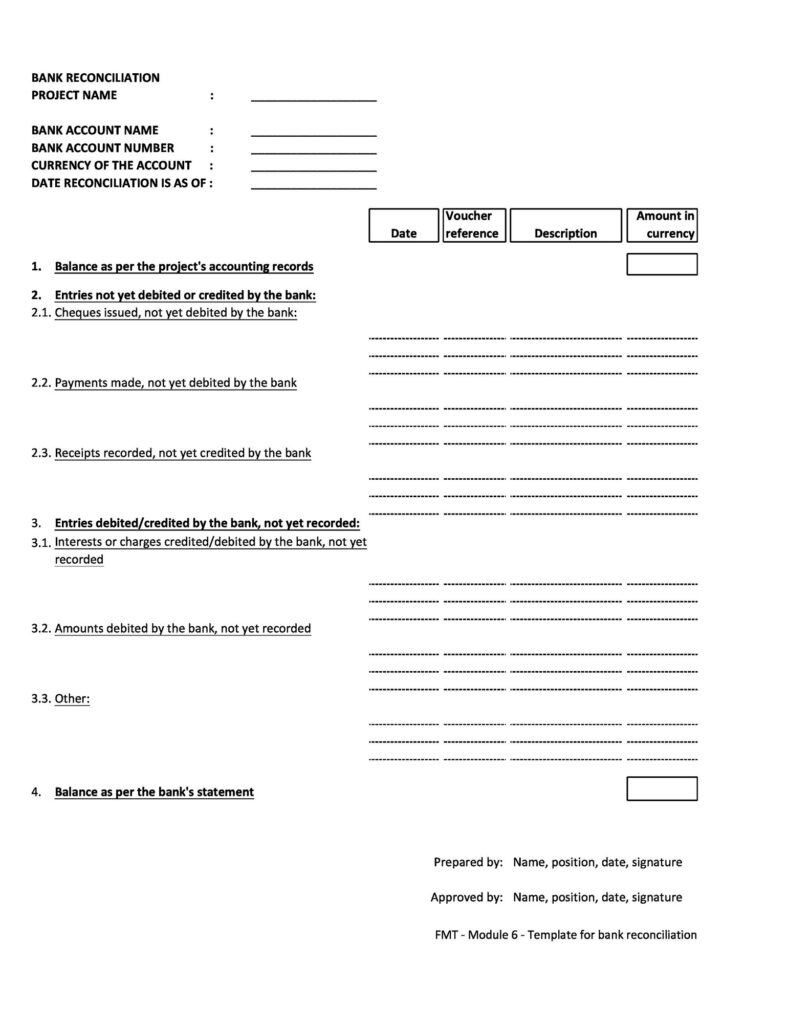

Bank Reconciliation

Another essential facet of using a design template form to reconcile your account once a month is this will enable you to place any kind of type of accounting mistake, both your own as well as the banks in a very much previously stage in period and once again can end up assisting you conserve overdraft costs and the shame of having a check leap or your debit cards declined.

If you are looking for any bank reconciliation template to create this task very much easier every single month you will notice that presently there are many sites on-line that present templates that you should download. Since this is usually a relatively simple process, you require to ensure that the template you select will not really over complicate the procedure. Most importantly you have to make sure you reconcile your account every month to enable you to place any kind of complications that happen in their particular songs prior to they will certainly end up charging you a great deal pounds.

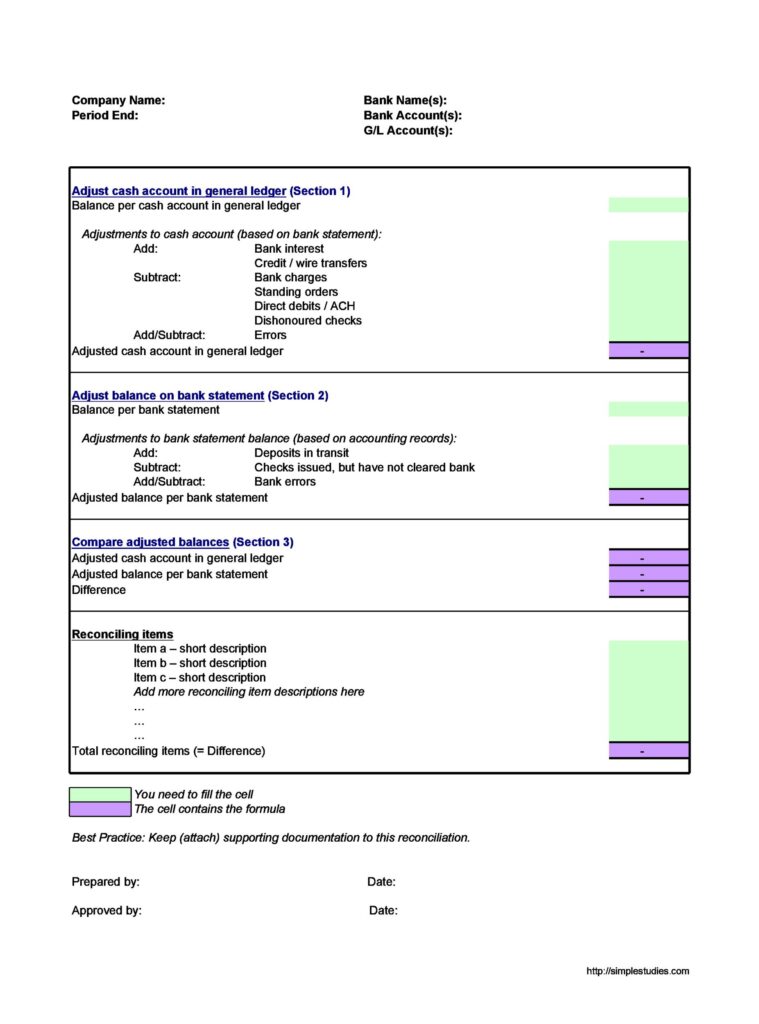

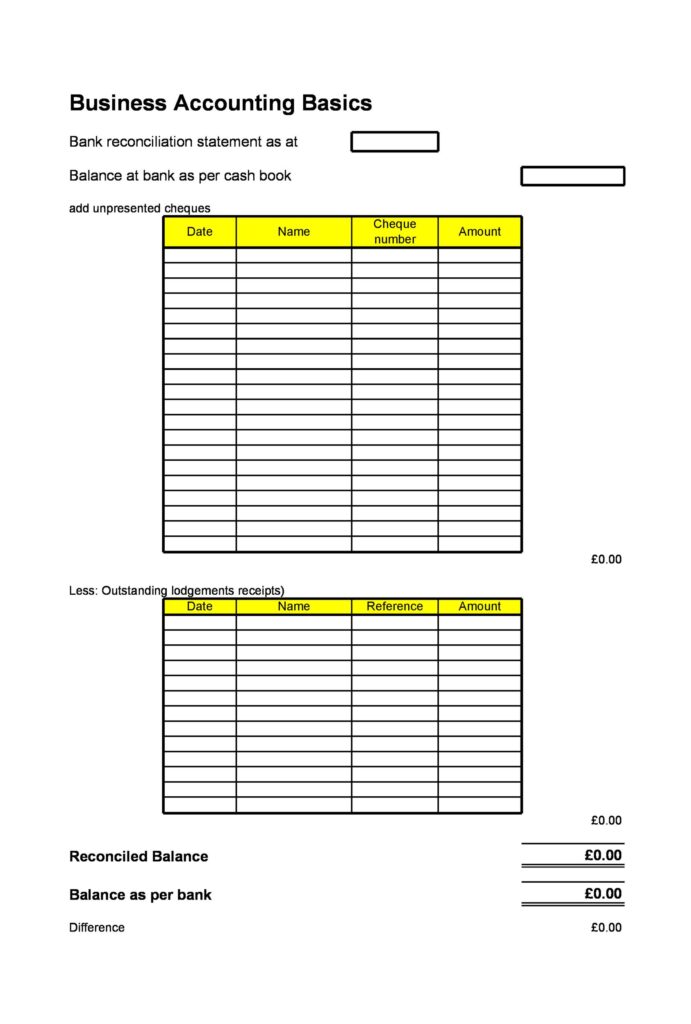

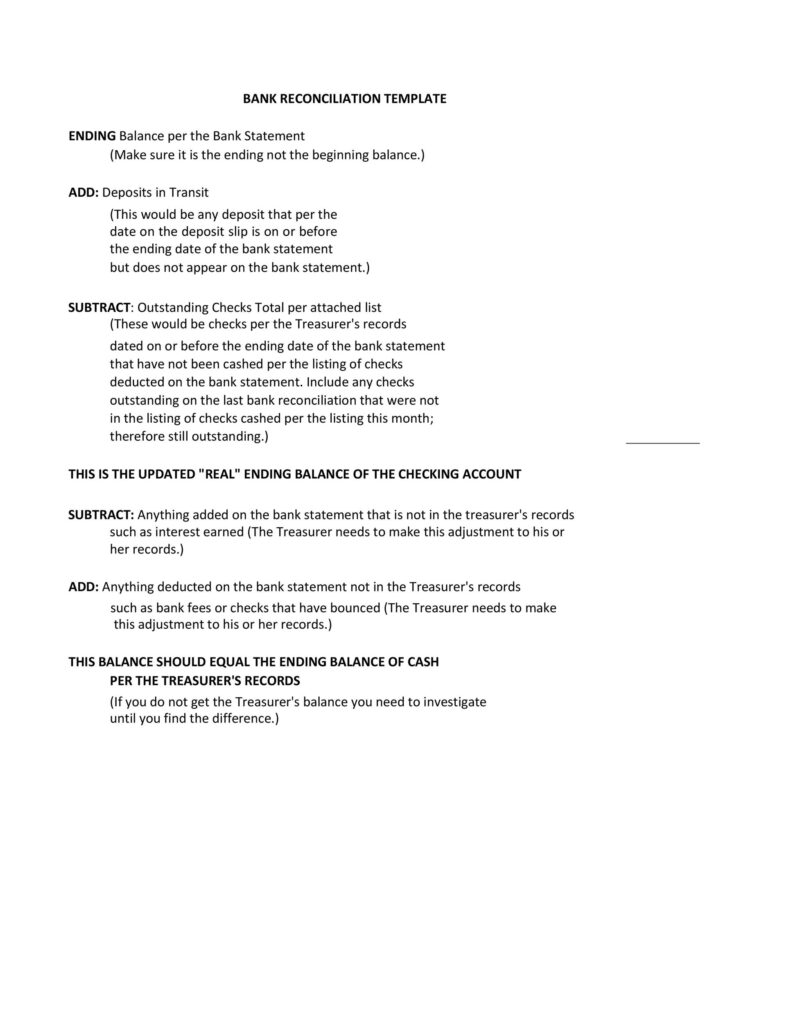

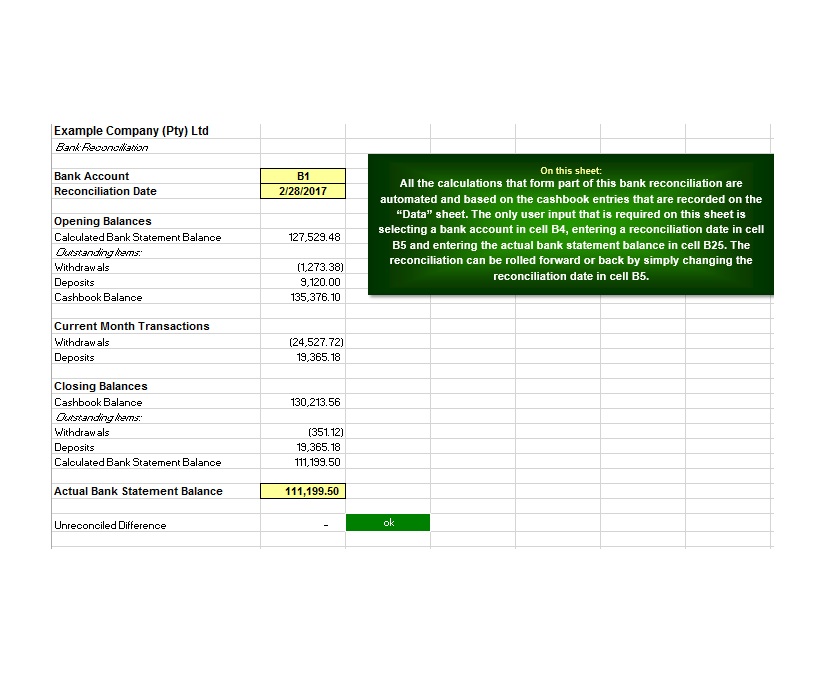

Bank Reconciliation Template

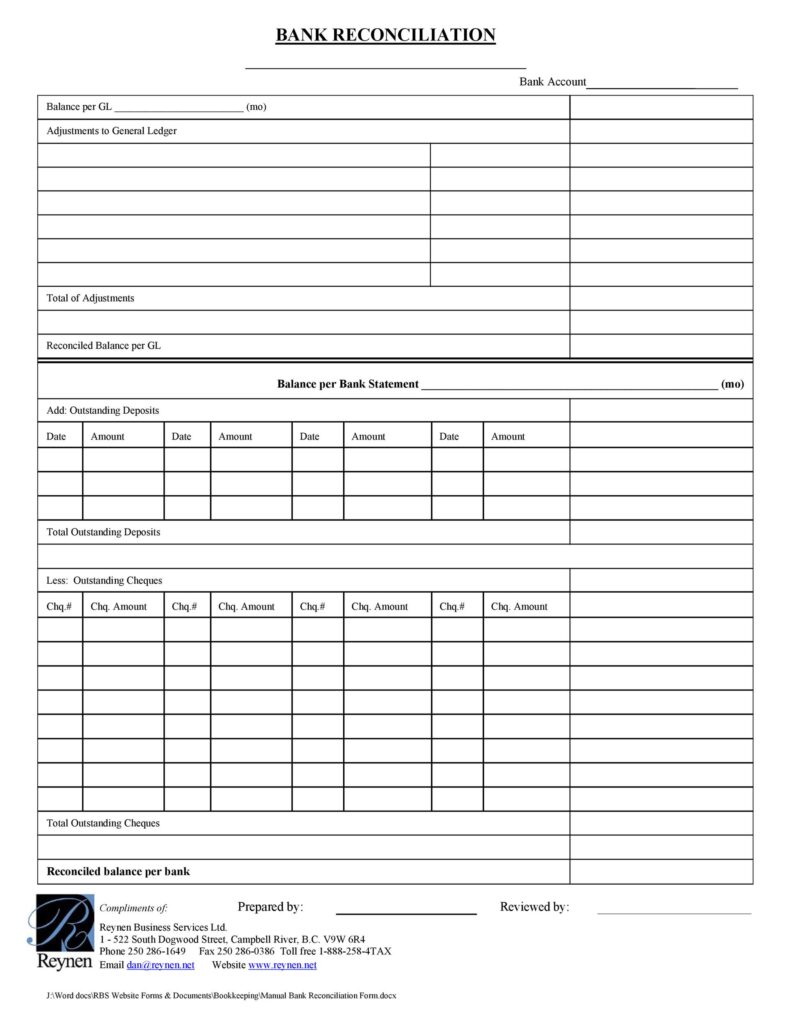

Keep in mind that apart from the regular reconciliation, this also offers a way to your excellent payments as well checks. Consequently, the instant you download a financial institution reconciliation template, make sure that this can accomplish these preferred goals. You should possess requested your Balance from the bank and become aware of your book Balance. Your reconciliation might need shifting in one Balance towards the other or vice versa and accounting for amount differences in among.

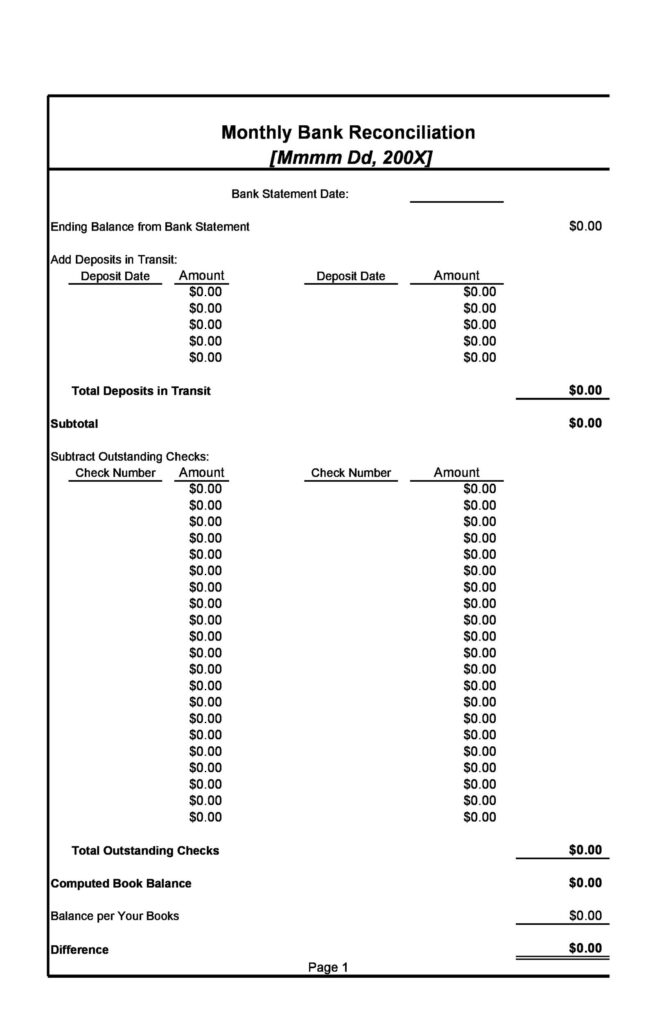

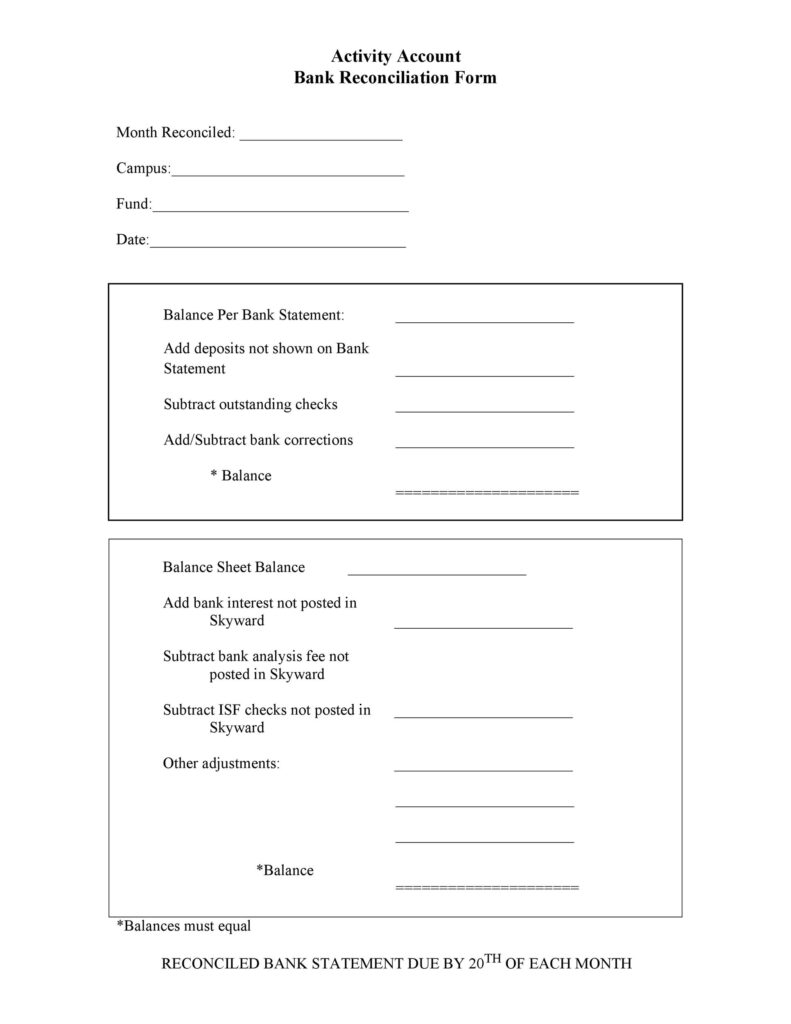

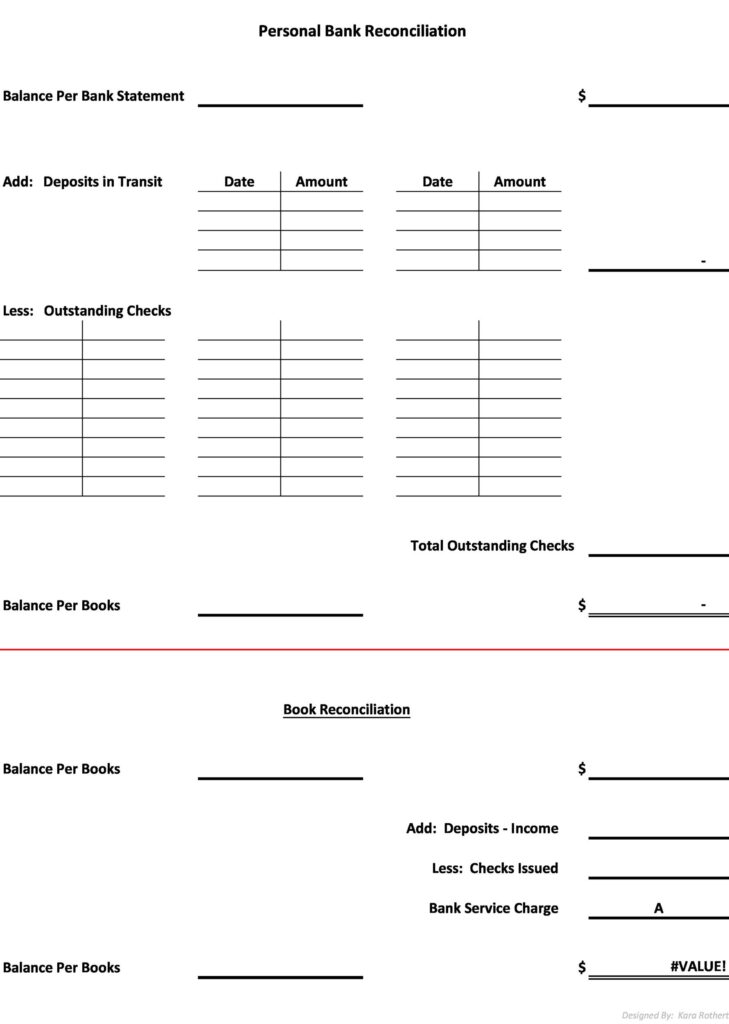

Intended for real reconciliation utilizing a basic bank reconciliation template, you want to perform the following:

-

Document your Balance per bank Statement

-

Add all deposits in transit

-

Subtract all outstanding cheques

-

Compare the added figures

If the added figures rhyme with you book Balance, then you are good. If not, you need to investigate and provide factors for the reconciling items. If you begin reconciliation through the book Balance, most other actions have to be performant impotence in the contrary path.

These types of templates are available in different formats on the web from ideal business files websites. This is recommended to pay for the excel form at types, so that they may deal with multiple calculations, if required. Also, the excel formats properly place statistics in content for easy reference.

With these suggestions and a solid bank reconciliation template at your disposal, you can surely end up being who is usually fit and looking ahead to your bank res just before they will appear.

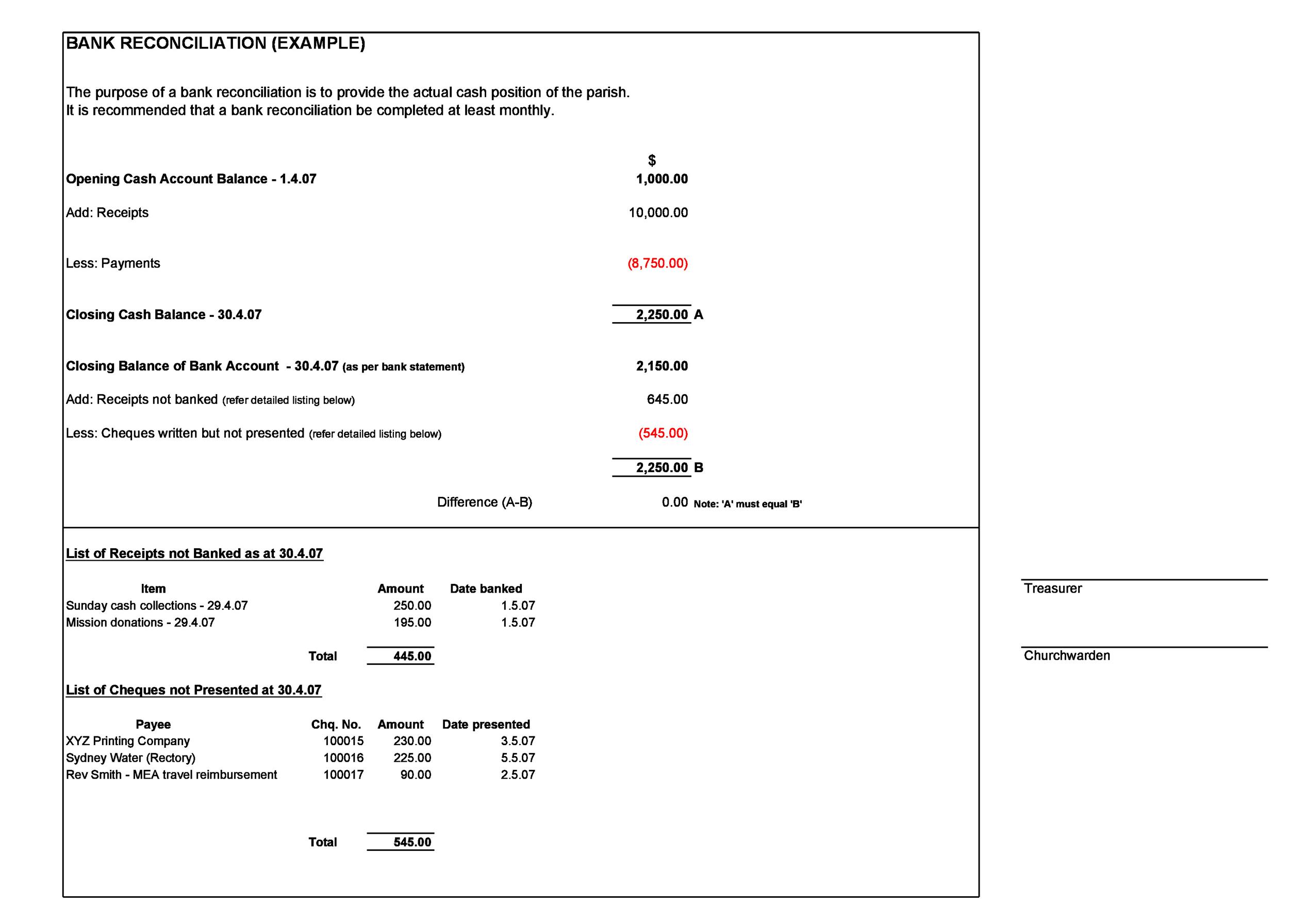

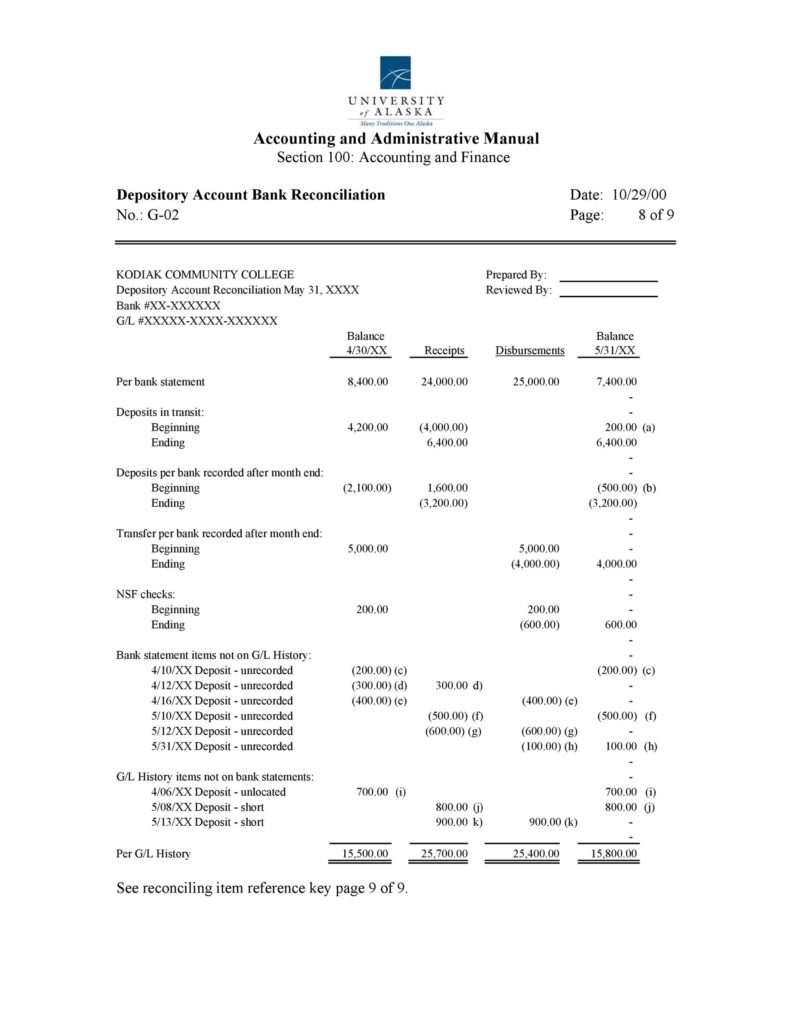

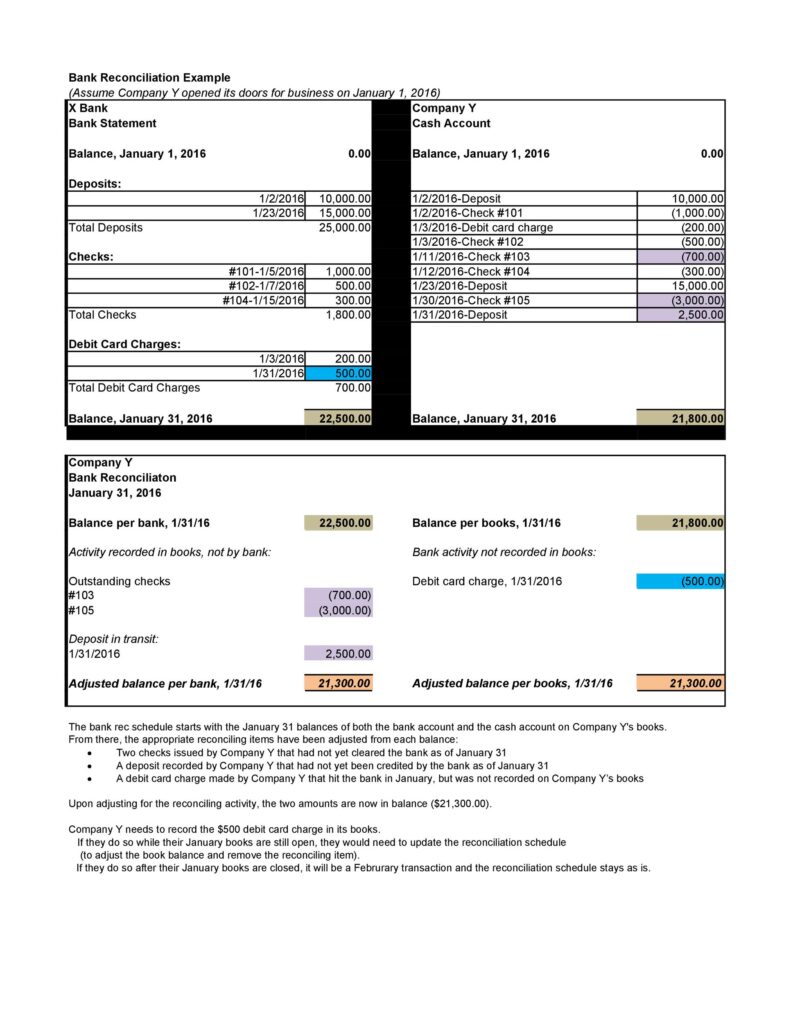

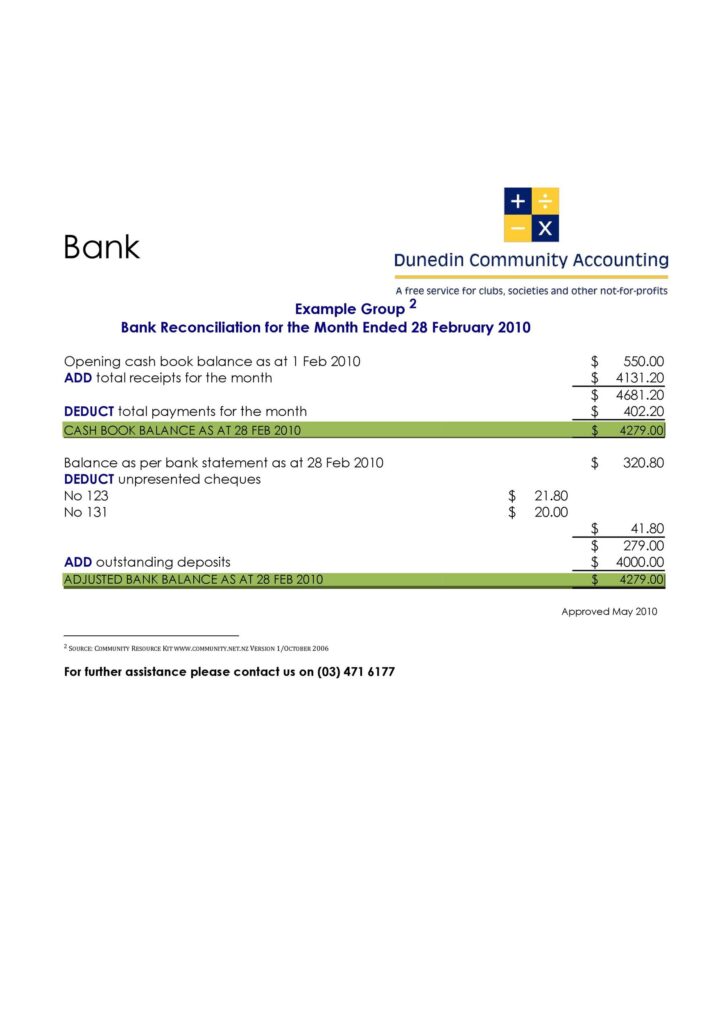

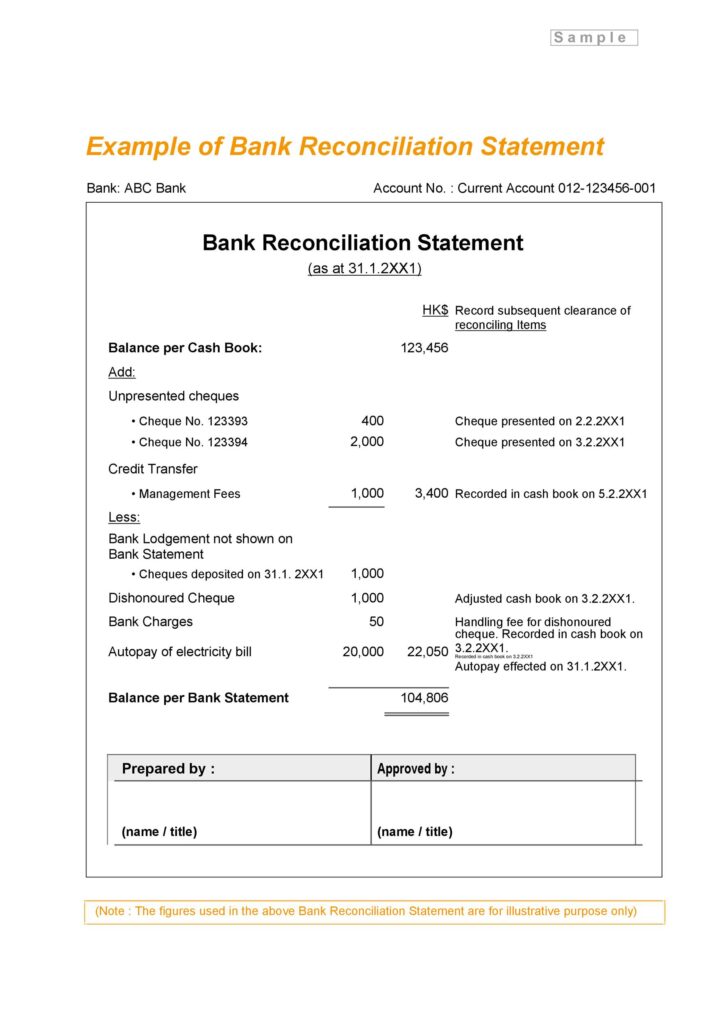

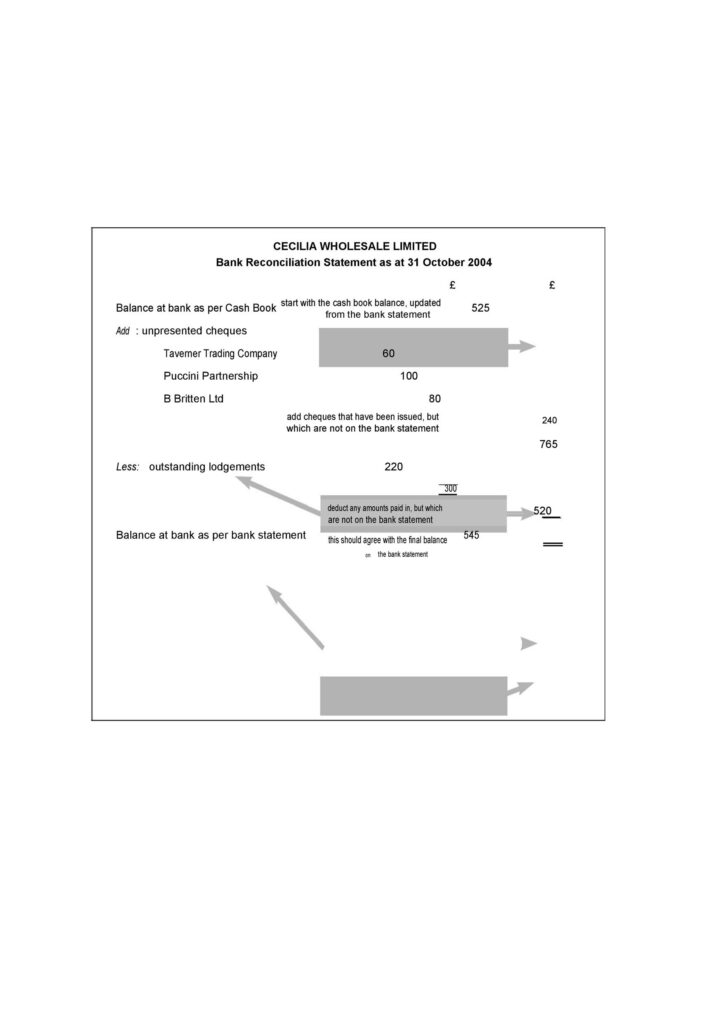

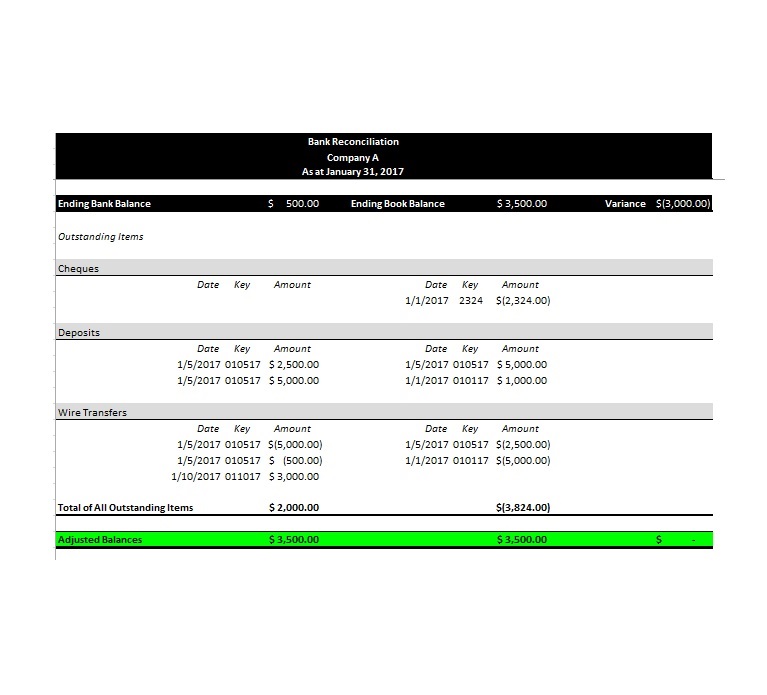

Bank Reconciliation Example

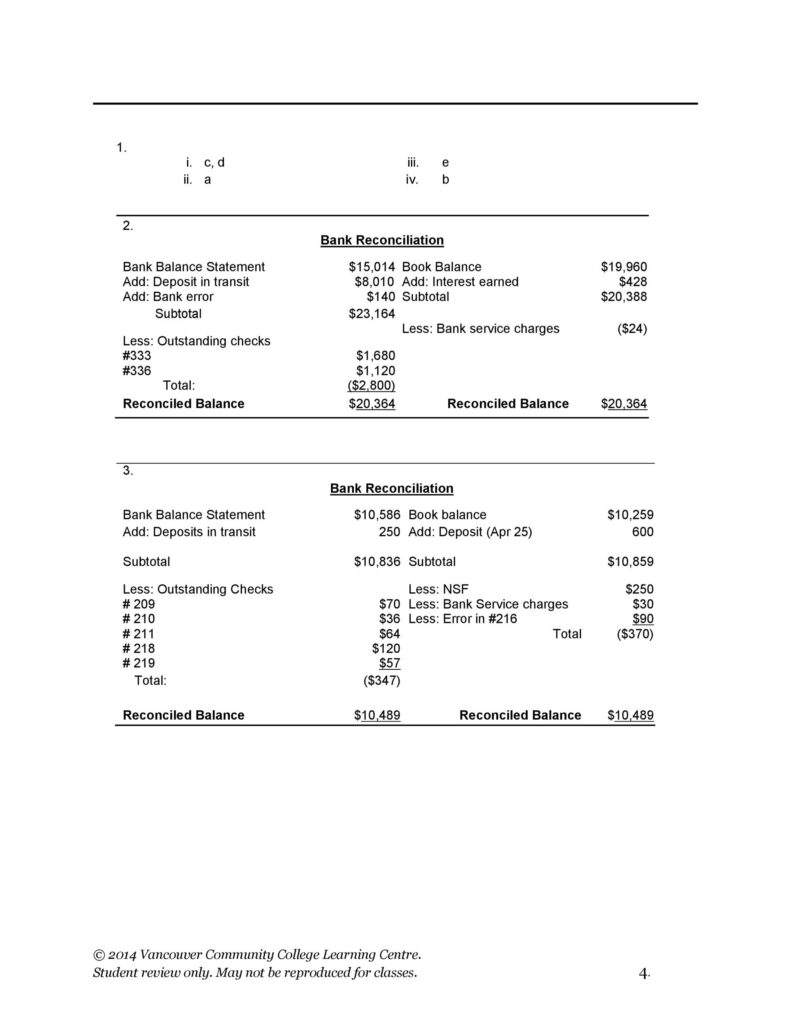

Throughout sectors, from farming to energy firms, bank reconciliation example varies a little, nevertheless the fundamentals as well as the process included are the same.

Prior to going on to explore these types of examples, all of us must maintain the following in mind:

-

Calculated and Noted

The total quantity difference between current bank Statement and cash book must end up being determined and mentioned. reconciling products need to equivalent this, in the event that not nevertheless treated.

-

Compare Cash and Cheque records

in the books with the bank Statement to recognize products which consider the Statement, but not really in the cash book and vice versa. Any kind of difference observed needs to be modified to get.

-

Make required adjustments to the cash book.

-

Reconciling items

Any differences pending will make up the reconciling items which can include un-presented cheques and deposits in transit etc.

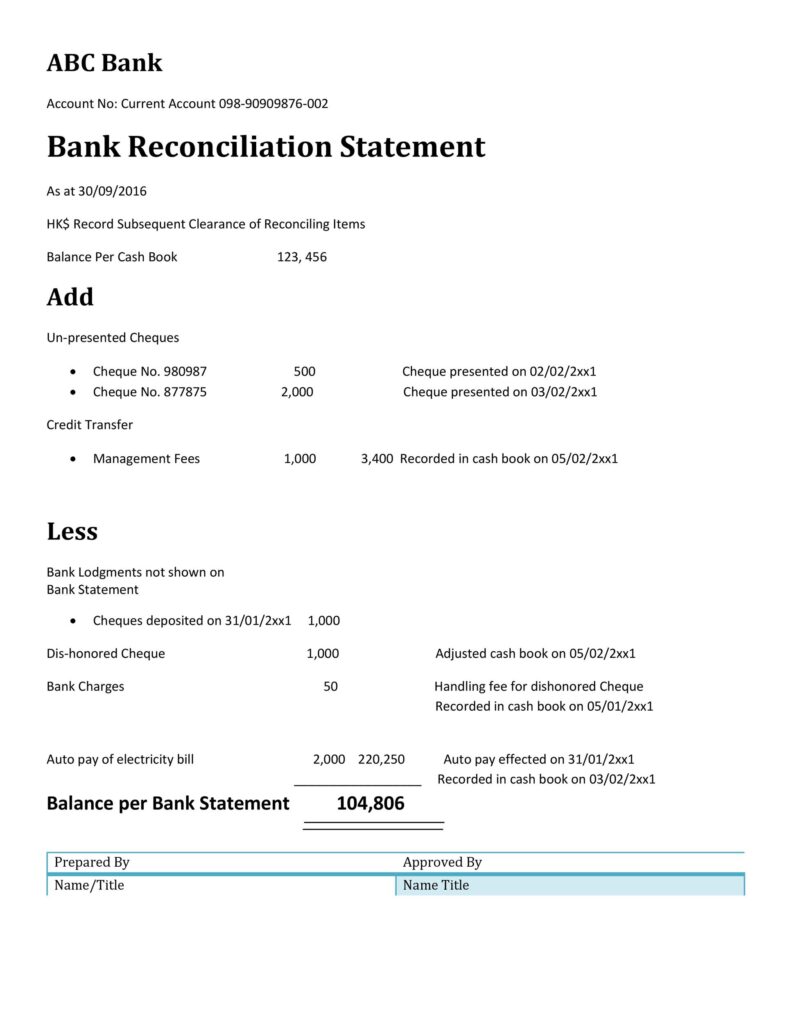

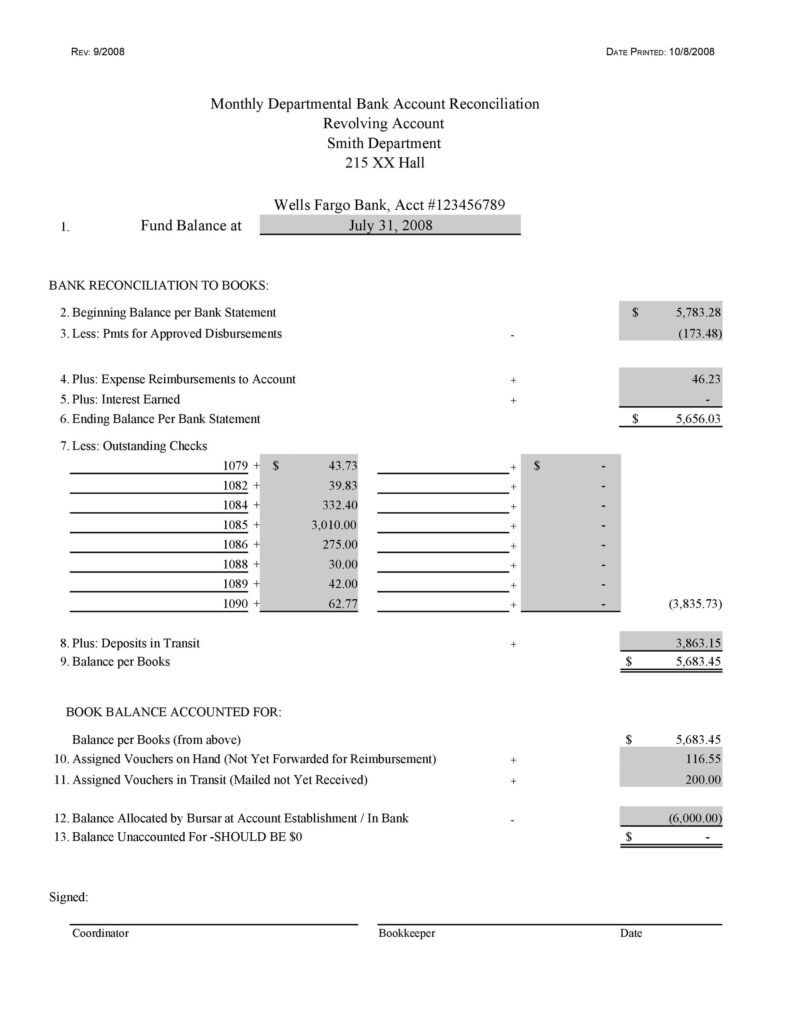

Centered on these types data, all of us are capable to right now evaluate a bank reconciliation example. This example is comparable to that used pertaining to the present account reconciliation in most companies. reconciliation might usually be performed in two directions specifically: from the information or journal to the bank Statement and vice-versa. Everything is virtually the equal, other than that procedures of improvements and subtractions change themselves when shifting in reverse directions.

After making a few the preliminary methods over, the reconciliation attendant can type in the numbers into his template or application software program component. When shifting from journal Balance to Balance per bank Statement, you take away most deposits in transportation and put up every outstanding cheque to turn up exact same quantity while the bank Statement. In the event that there are still variations at this point, consider any fees from the bank that is definitely however to become captured.

In this time period, you might have got accomplished the substance from the reconciliation which usually is definitely to make sure that all exceptional items among both celebrations are recognized and correctly treated in the books.

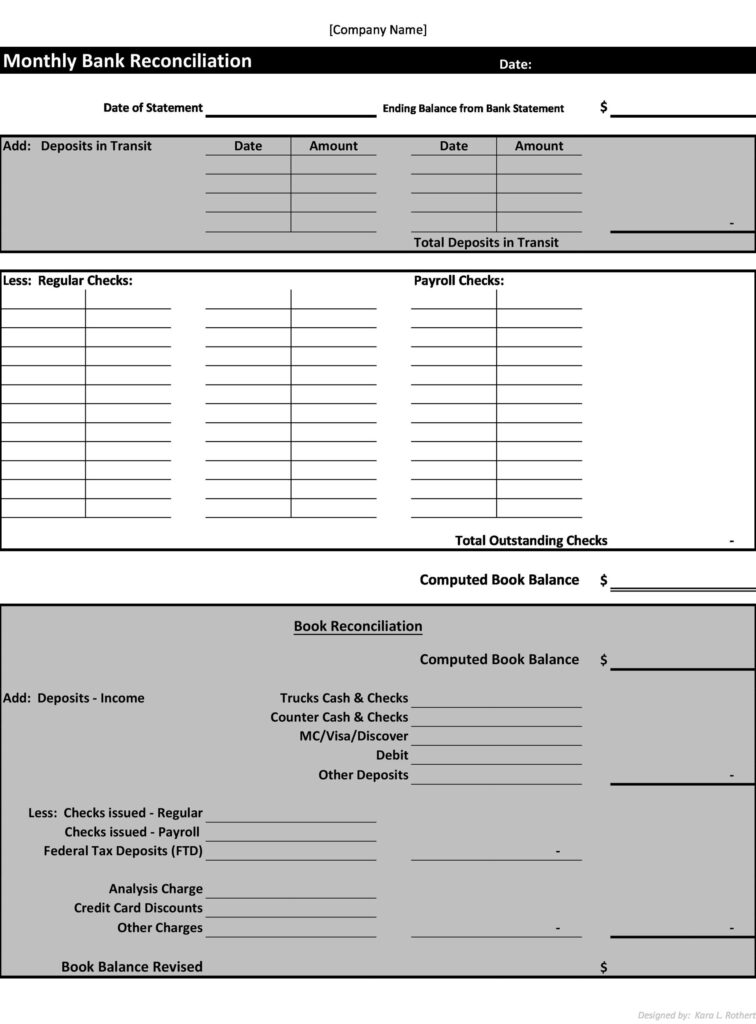

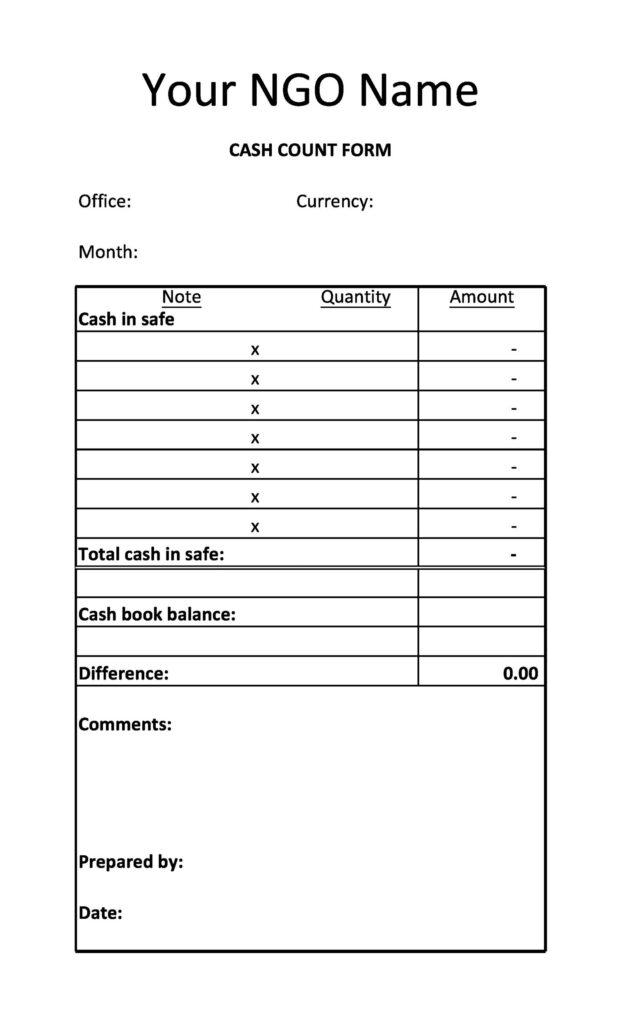

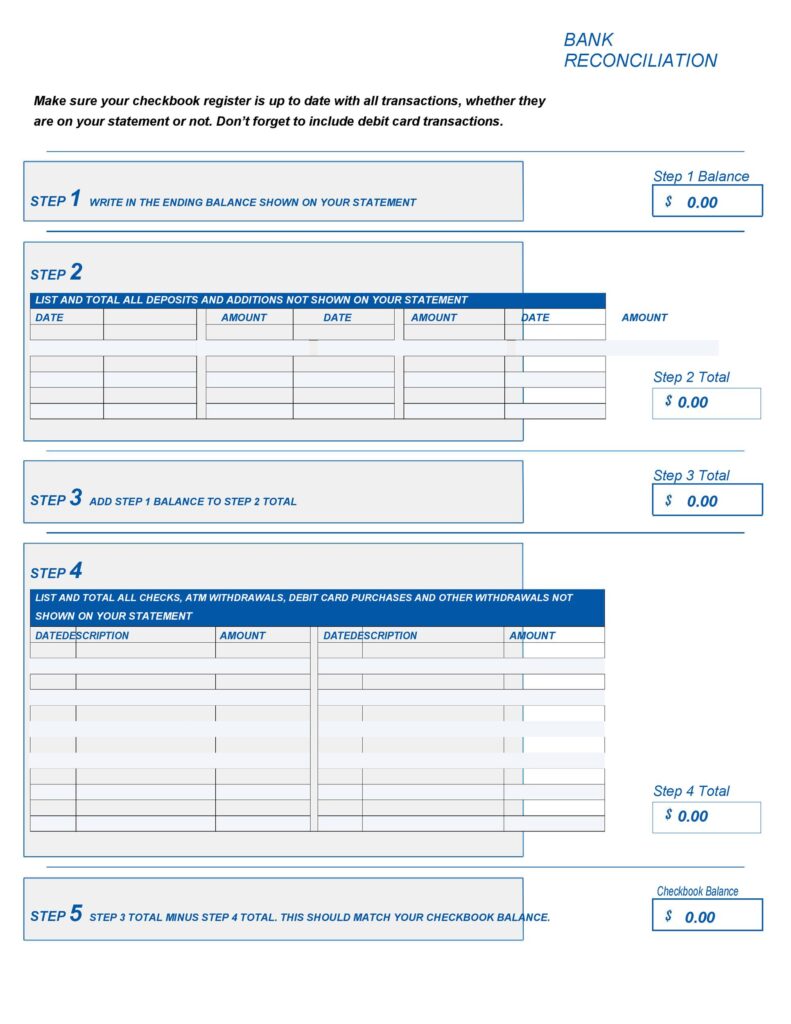

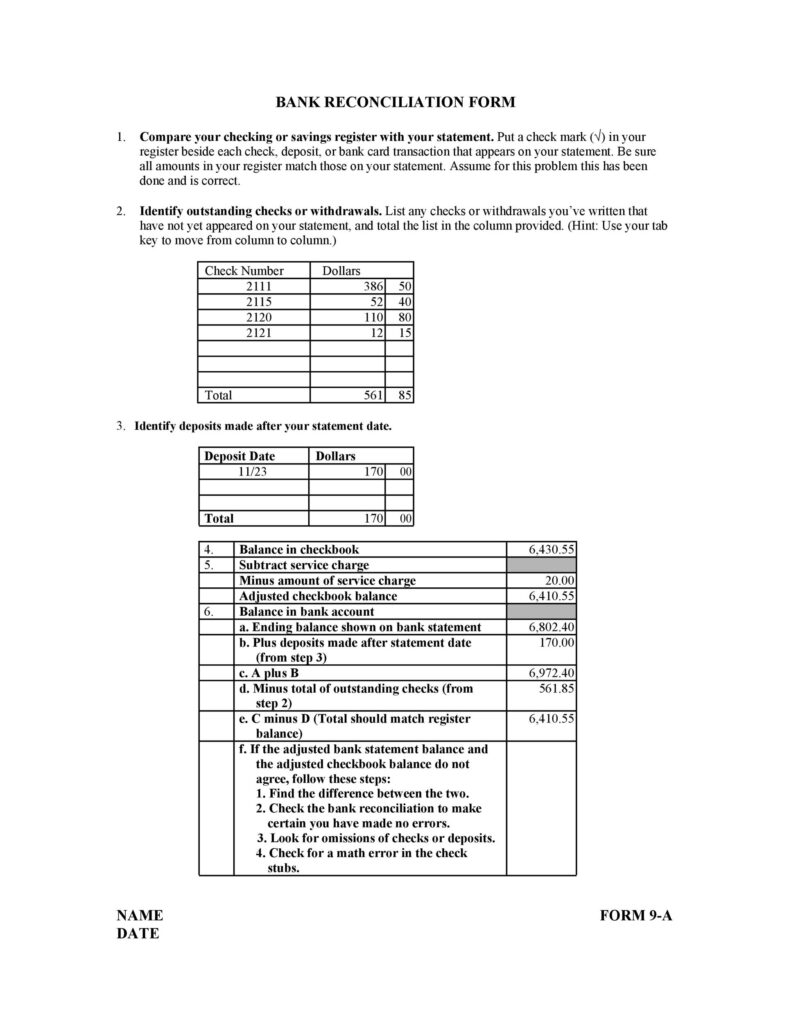

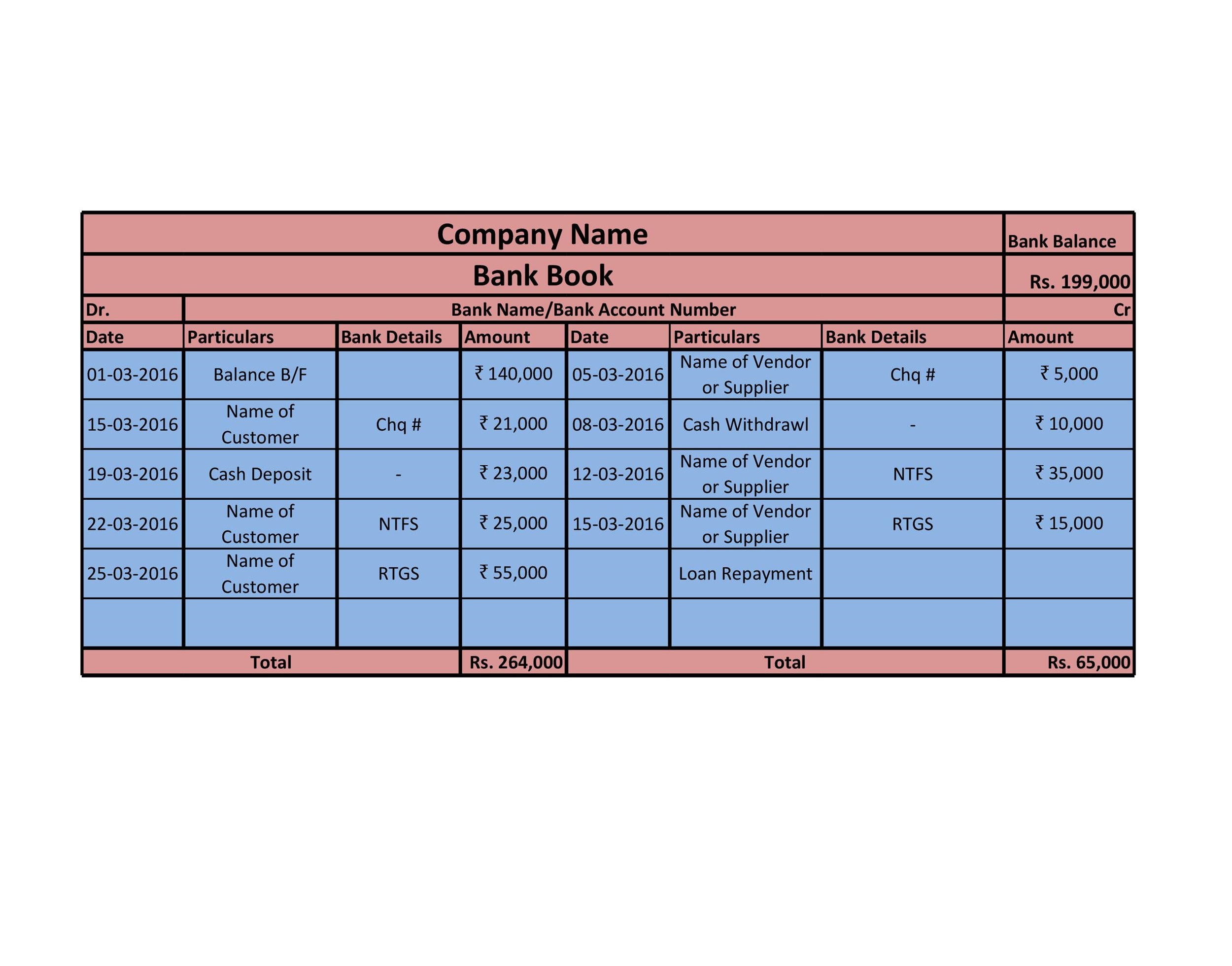

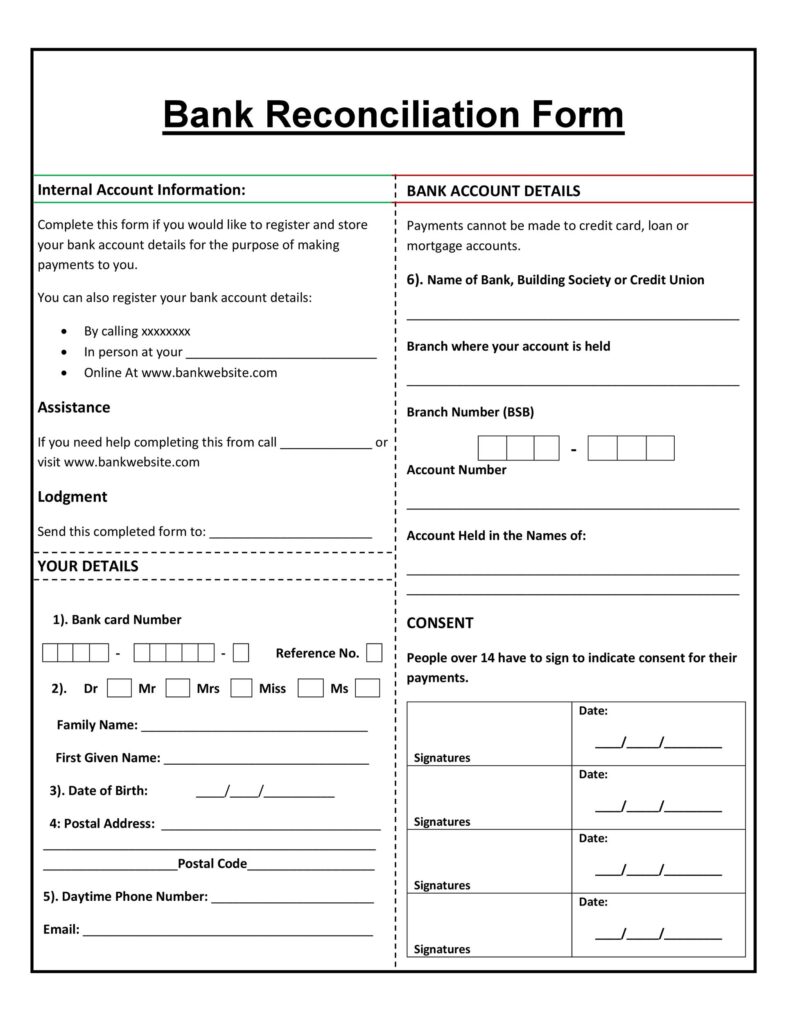

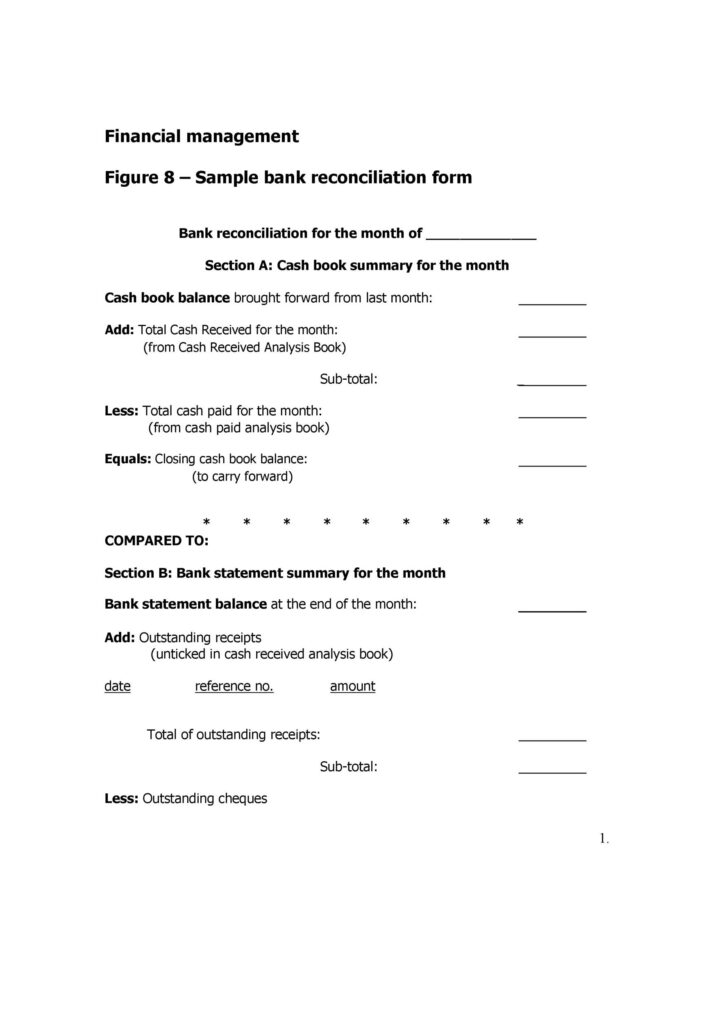

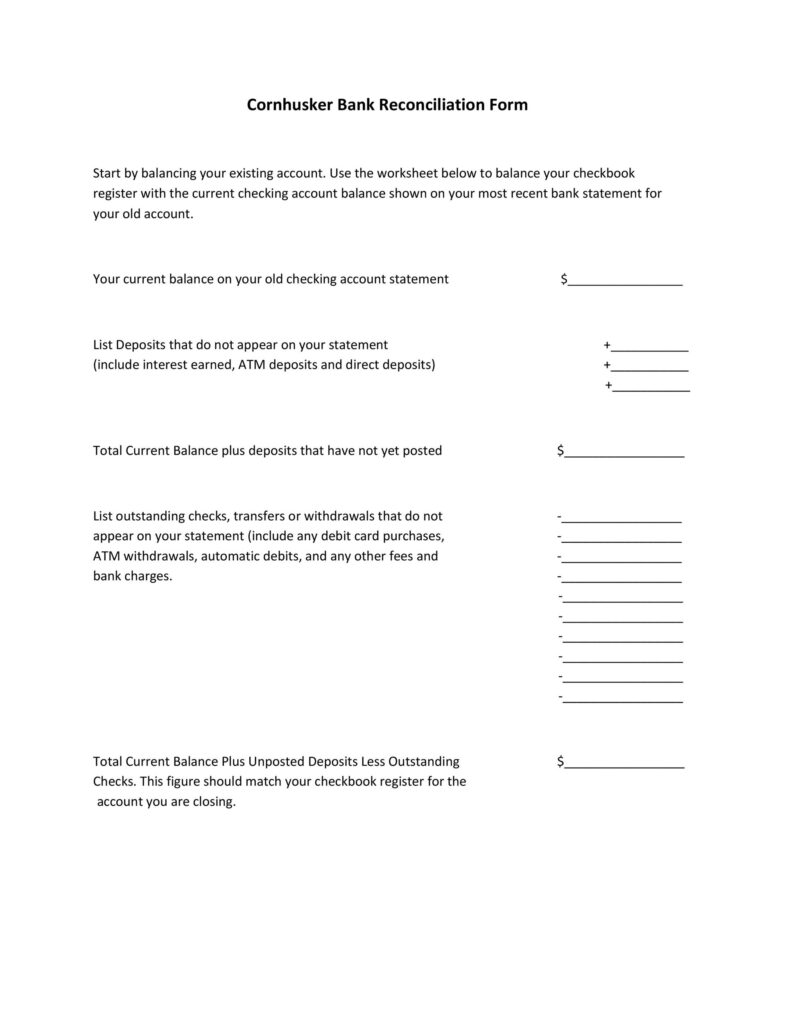

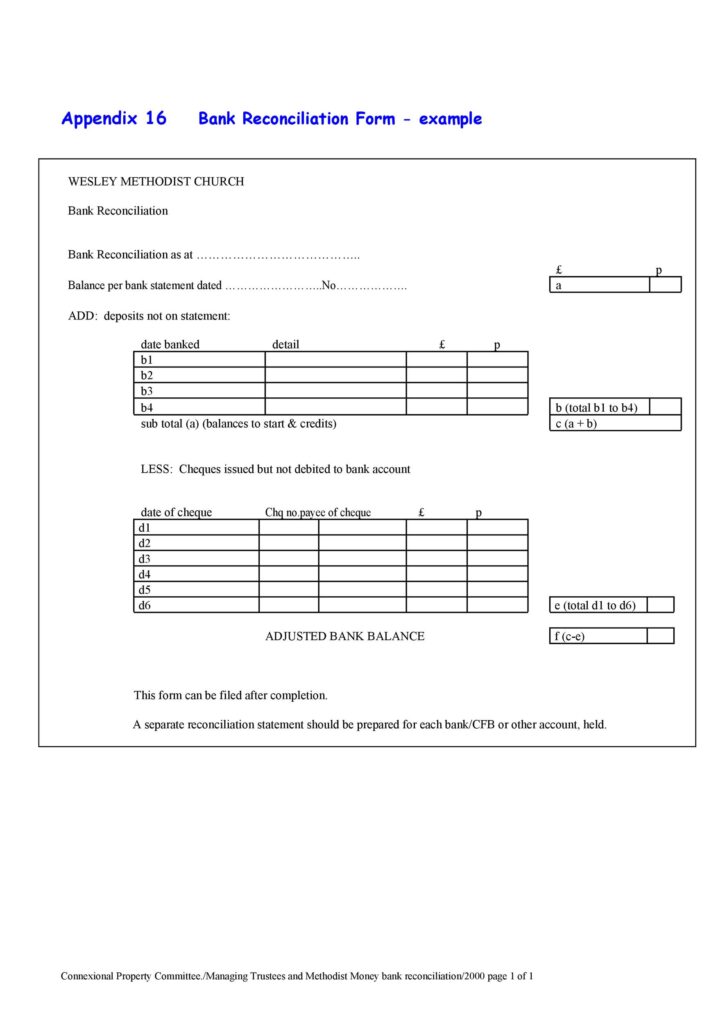

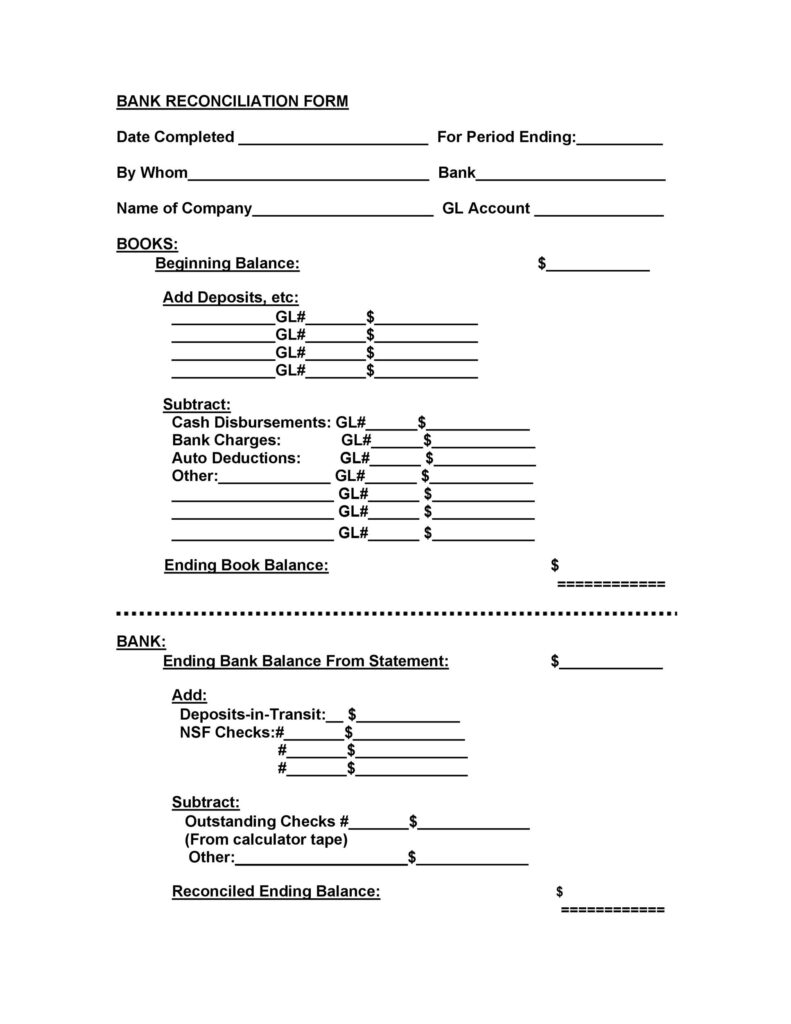

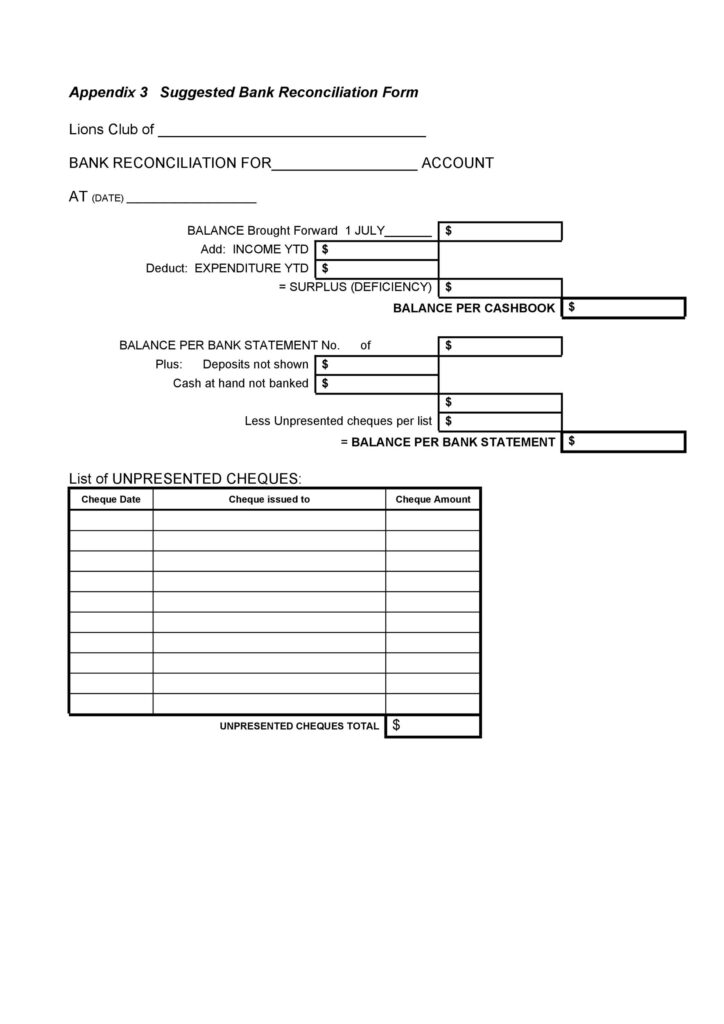

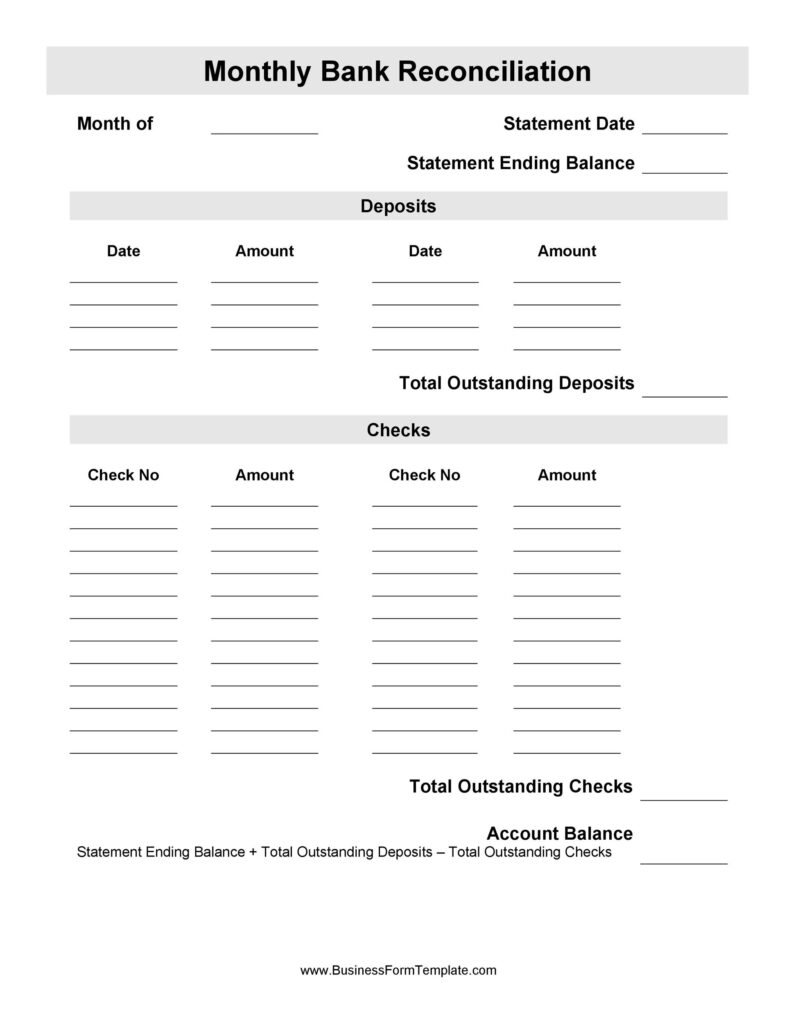

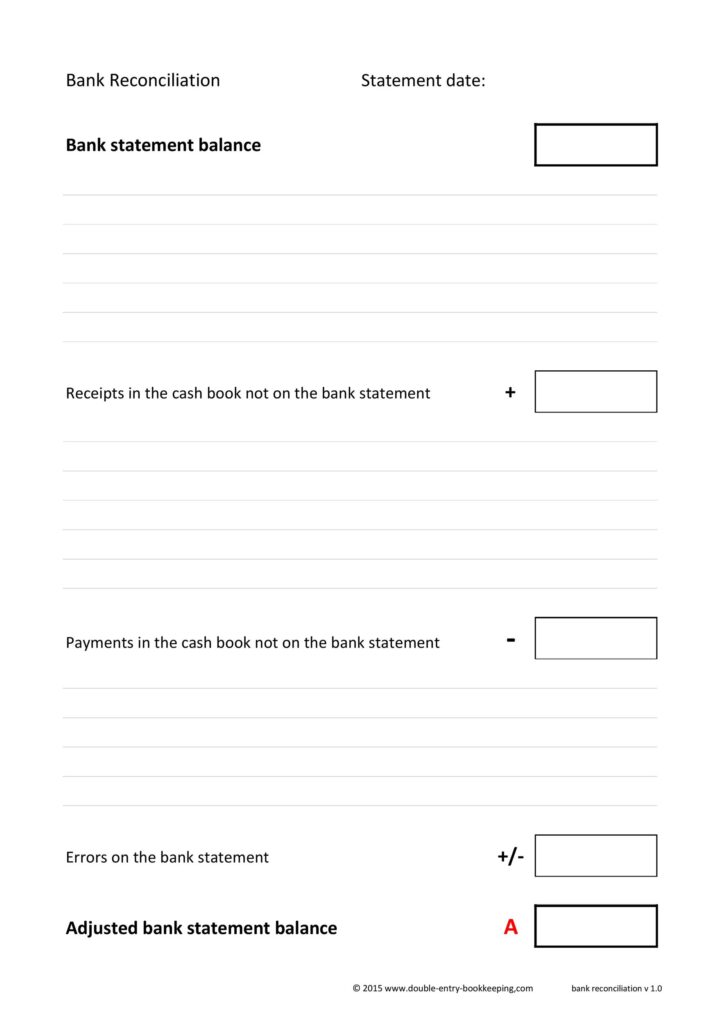

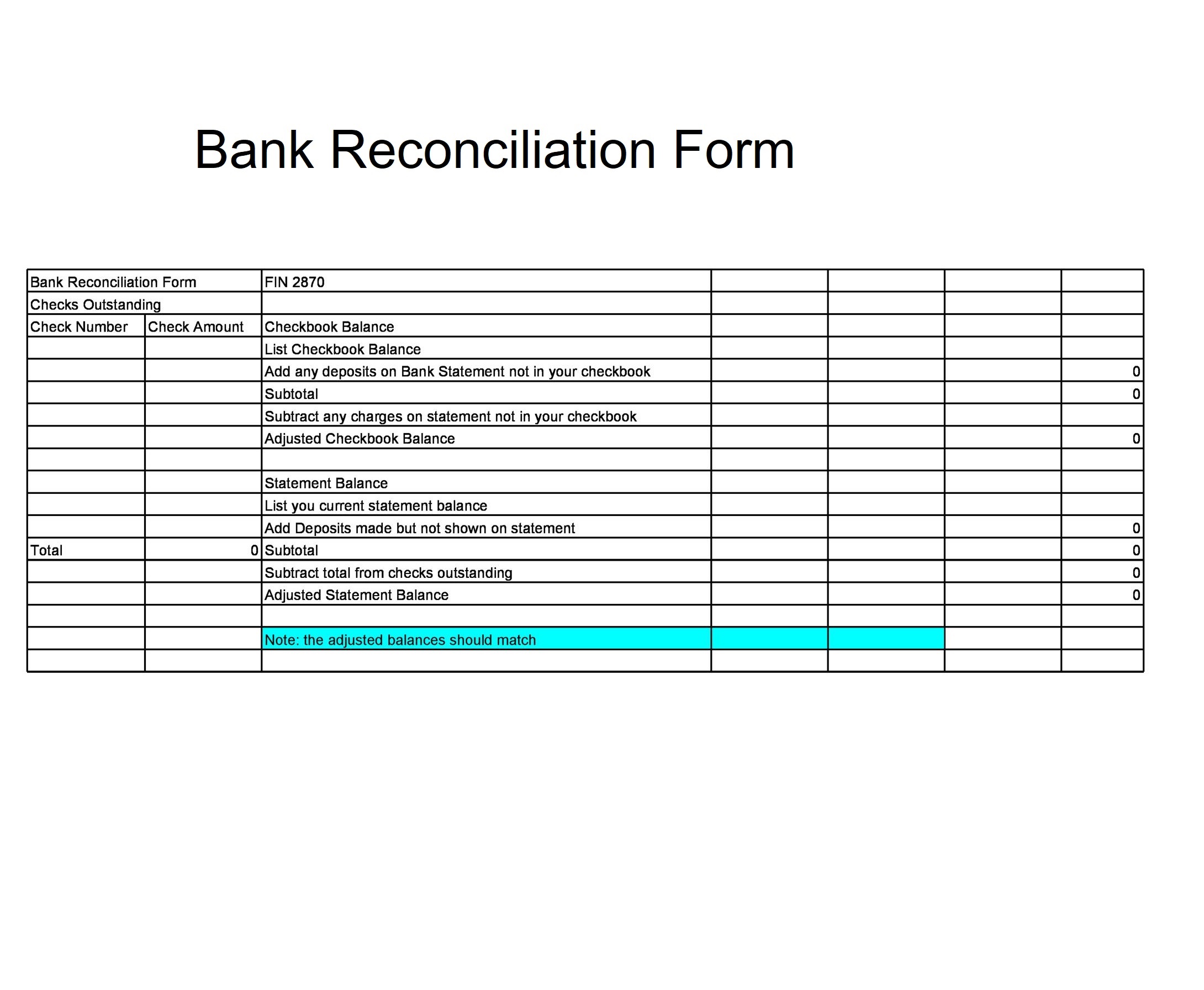

Bank Reconciliation Form

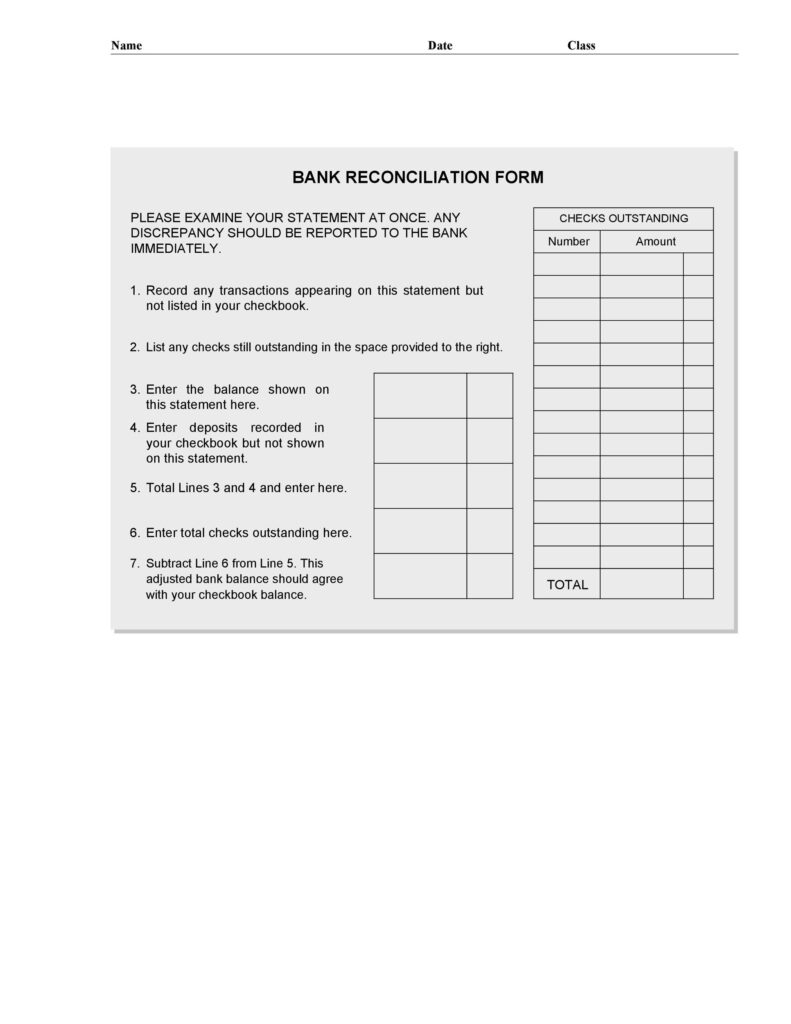

This form allows you to list every single transaction you have got documented in your check book collectively with of the types that the bank offers a record of. reconciliation occurs after you have matched almost all transaction h and are remaining just with all those that you show the bank will certainly not. Simply by subtracting these types of from your Balance you display, it can match the actual bank displays.

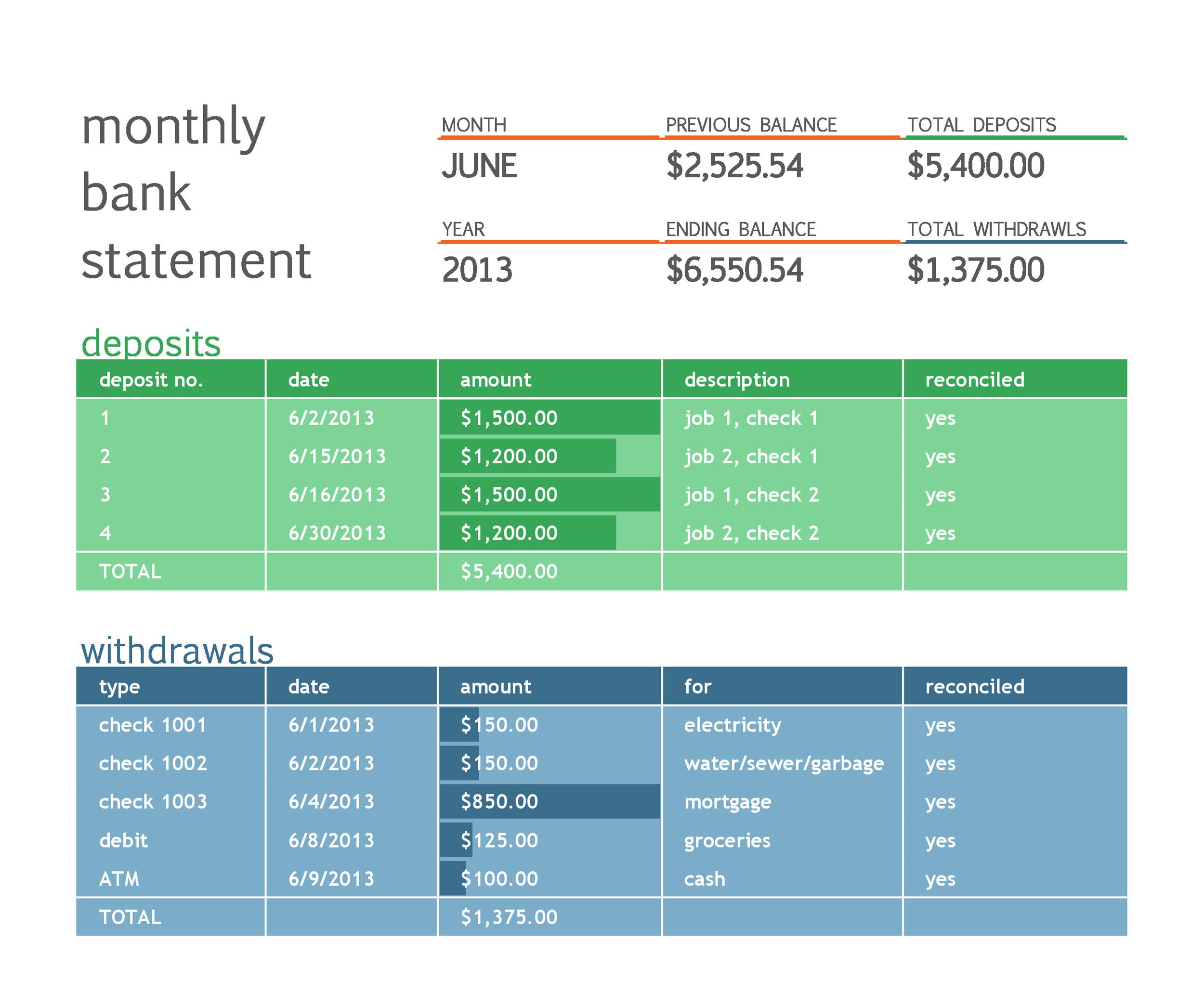

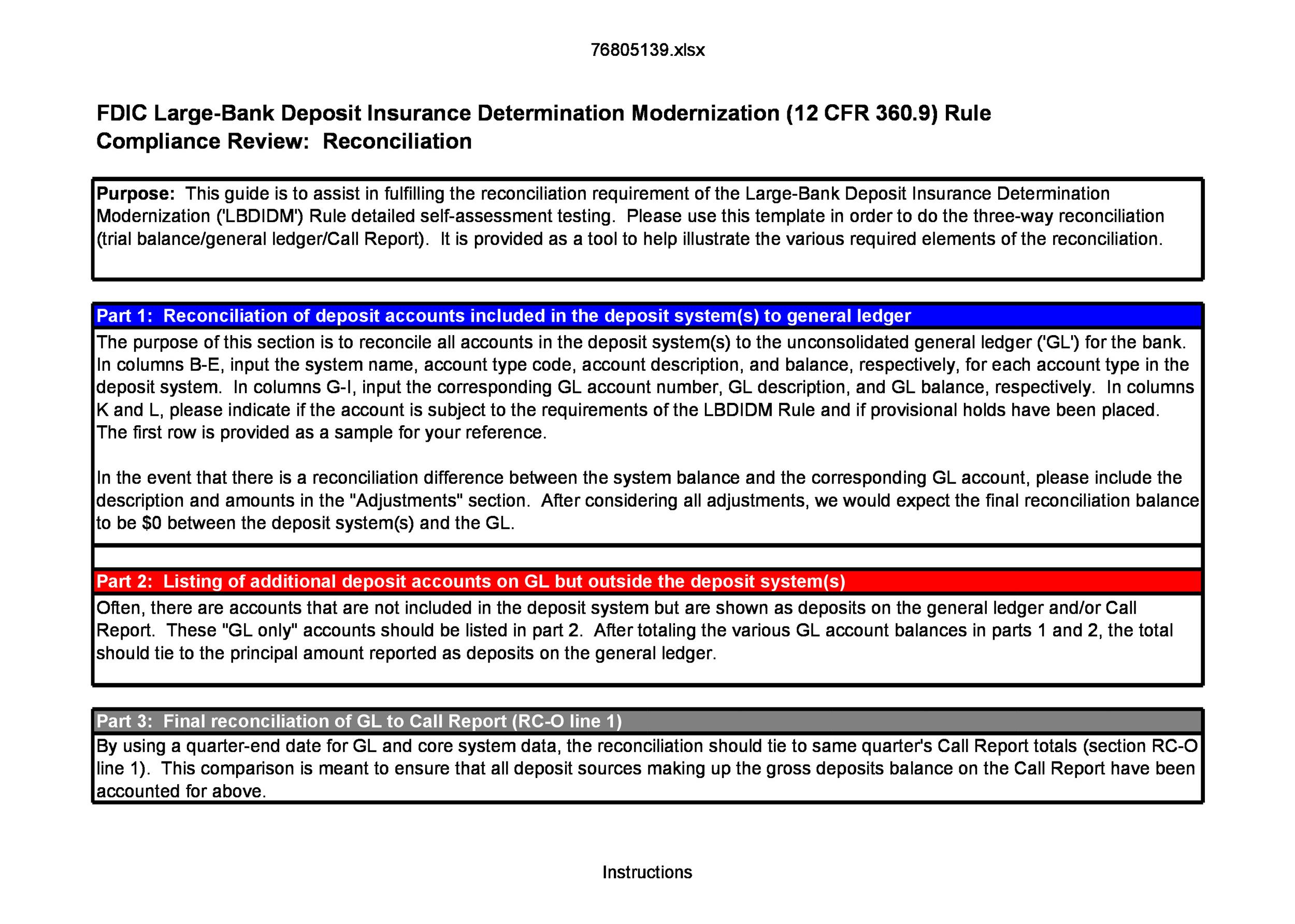

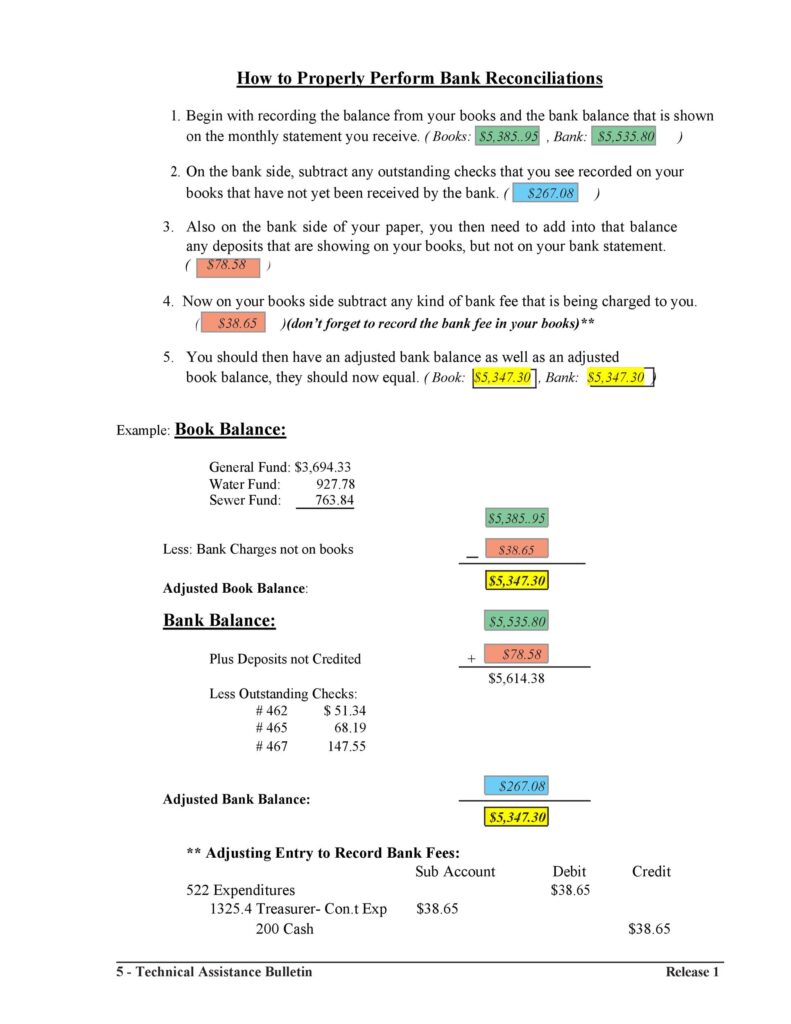

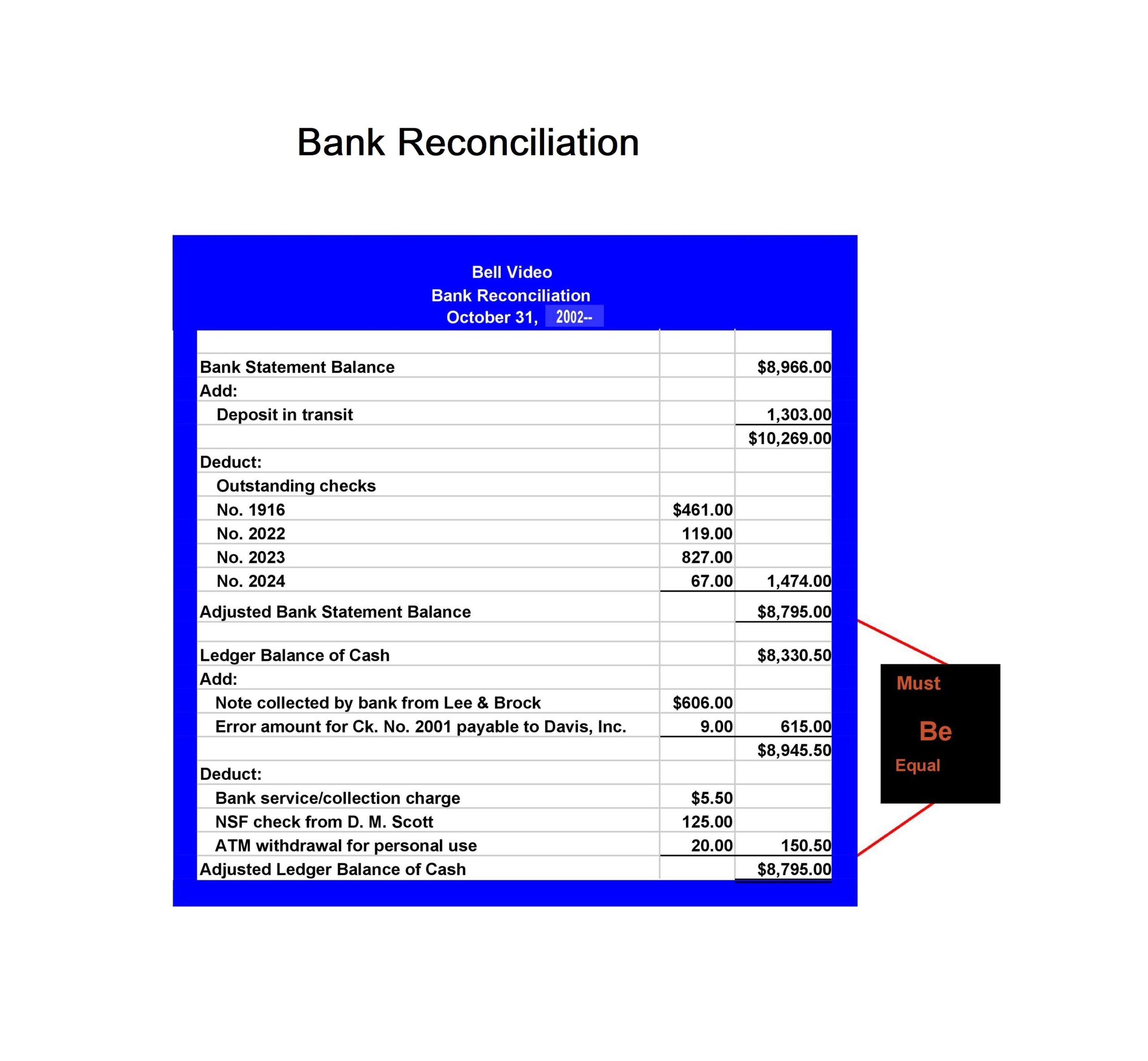

How to Reconciliation Balance Bank Statements

Balancing bank Statements, also called cash reconciliation, can be a significant tool to verify the cash Balance s of the business. Mistakes might happen in the bank or at the industry’s accounting books, and this reconciliation can help get this kind of problems, permitting for businesses to right all of them.

Balancing Bank Statements is usually a getting back together between two numbers, generally done month-to-month:

-

The closing Balance upon the bank Statement

can become hundred money

-

The Balance on a check register or cash account

it can end up being $250

The queries are: Exactly what are the differences among these two figures? So why the amount in the bank be different in the 1 in the books? Can it become due to a mistake? Or possibly a deposit acknowledged in the books is not however appearing in the bank? Therefore, the comprehensive evaluation between these types of two figures is the idea behind Balancing bank Statements

Bank Reconciliation Statement

Some Common Steps to Balance Bank Statements

This kind of reconciliation aids with identifying errors, producing sure that the cash Balance in the accounting books is appropriate. Below a few common steps to Balance bank Statements:

Obtain a bank Statement from the bank.

This could end up being paper or digital form in and is shipped every month. You may also download this Statement from your bank is website.

Get a detailed check register.

showing every checks and deposits designed for the month.

Looking at the cash register.

label the checks that possess been paid by the bank.

Total up the checks.

Total up the checks not yet cashed, known as “Outstanding checks “.

Looking at the check register.

tag all of the deposits appearing upon the bank Statement.

Identify the deposits.

Identify the deposits not yet showing up at the bank, also known as ” deposits -in-transit.” These are generally the types carried out around the last day time of the month.

Identify any odd discrepancies.

involving the check register and the bank Statement that are NOT connected with the excellent checks and deposits -in-transit. These types of are generally errors or adjustments that need your interest. This could become that a $400 deposit in the bank was book male erectile dysfunction as $40 on the accounting information.

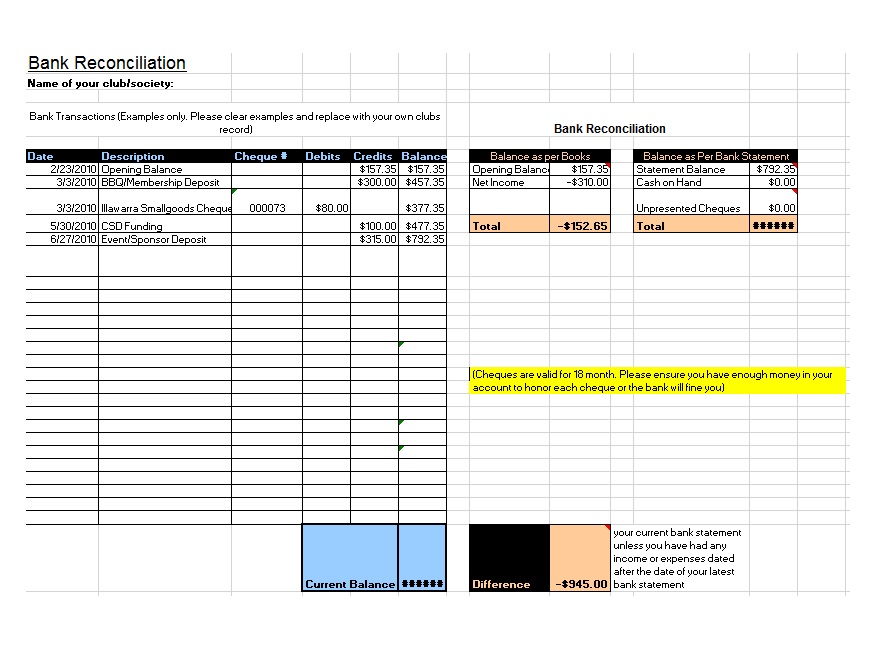

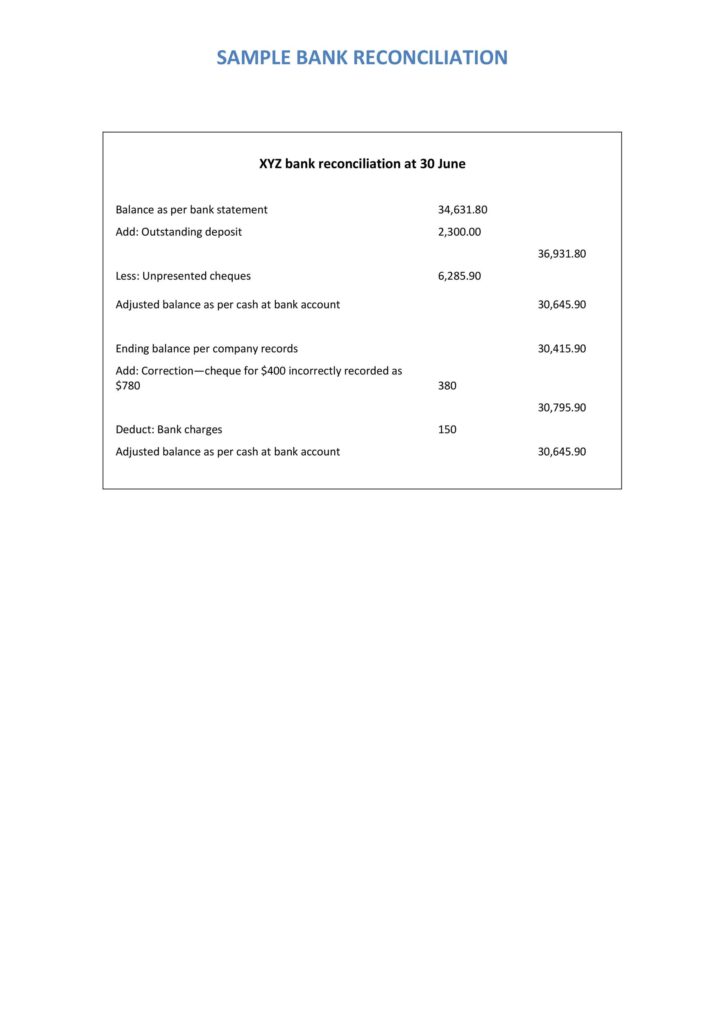

Bank Reconciliation Sample

Below is a simple template for bank reconciliations:

Bank Balance ____________

Less outstanding checks total ____________

Plus, deposit-in-transit total ____________

check register Balance ____________

Some people choose to include all of the errors or omissions toward the reconciliation and right all of them after the reconciliation is done. With respect to the scenario, this can work well. In the event that this is certainly the case, then the bank Balance is usually adjusted to access the check register Balance.