The letter of Guarantee refers to the written dedication provided by top banks in the U.S., according to the America Federal Deposit Insurance Corporation, there were 6,799 commercial banks that the FDIC insured in the U.S. in February 2014. at the request of customers who have terminated purchase contracts, purchase and purchase agreements (SPA) represent the final outcome of important business and pricing negotiations.

Basically, its units contain the agreed deal factors, contain some important protections for all affected events, and provide a prison framework for ending the sale of goods. To purchase goods from suppliers by ensuring that the buyer meets the obligations arising from the contract concluded with the supplier.

In addition to the acquisition of goods, the letter of guarantee can also trade in degeneration, contracting and creation, financing of monetary organizations, leasing of large equipment, equipment rental agreements are contractual agreements, in which the lessor, who is the owner of the gadget, allows the lessee to apply the equipment to and claims export-import goods. It is also issued on request through the author’s name to ensure that they have the underlying assets directly and that it will be introduced with the help of financial institutions when decisions are implemented.

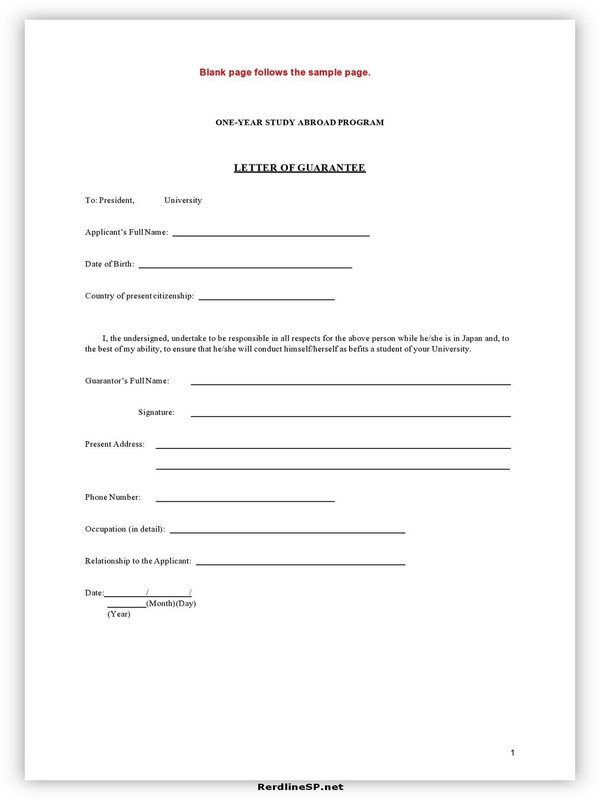

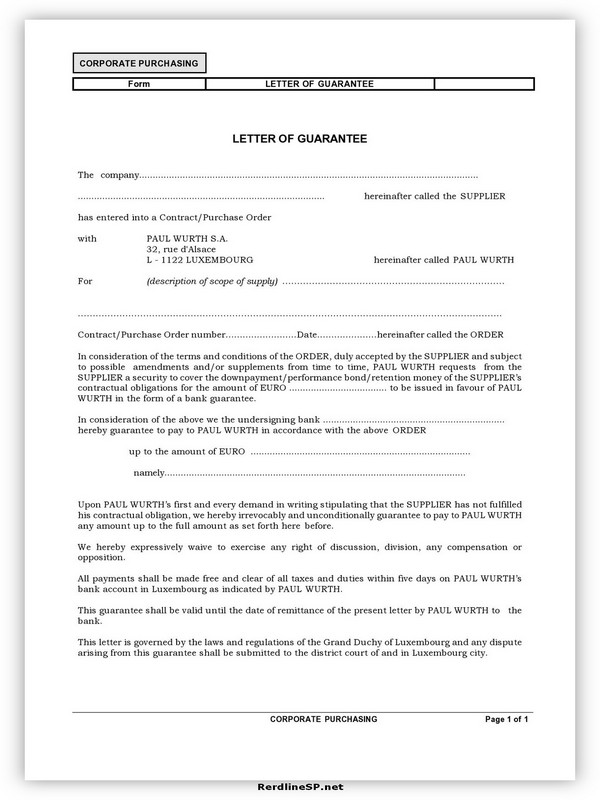

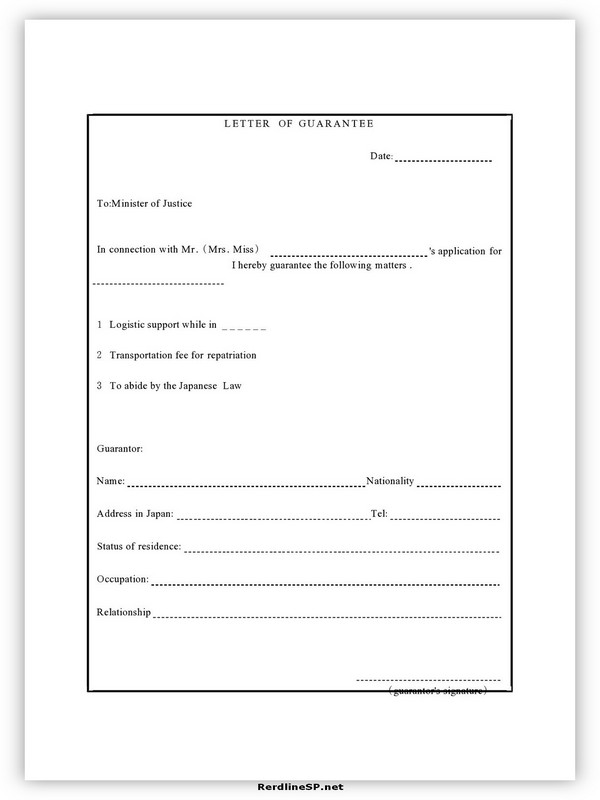

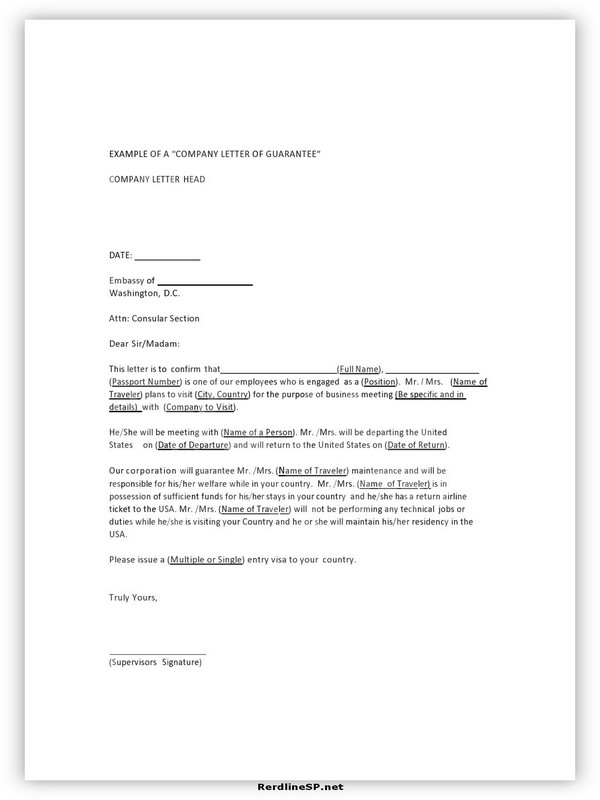

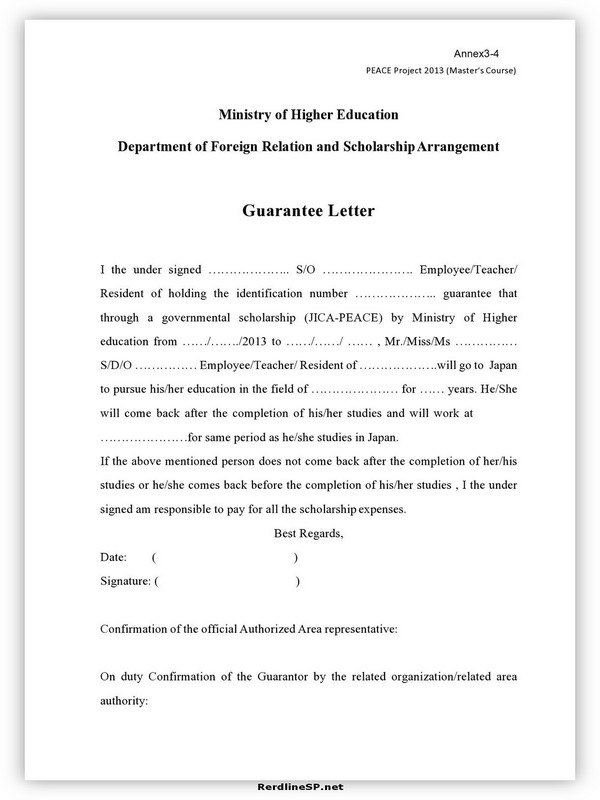

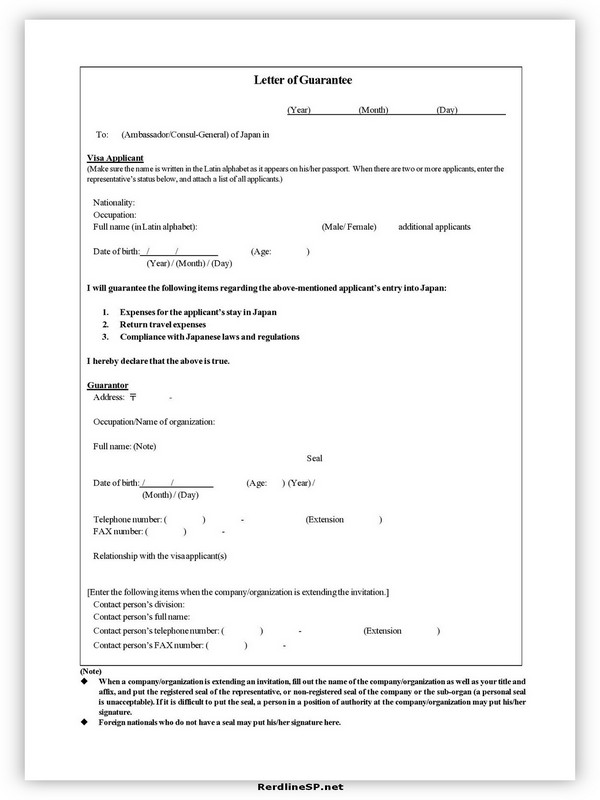

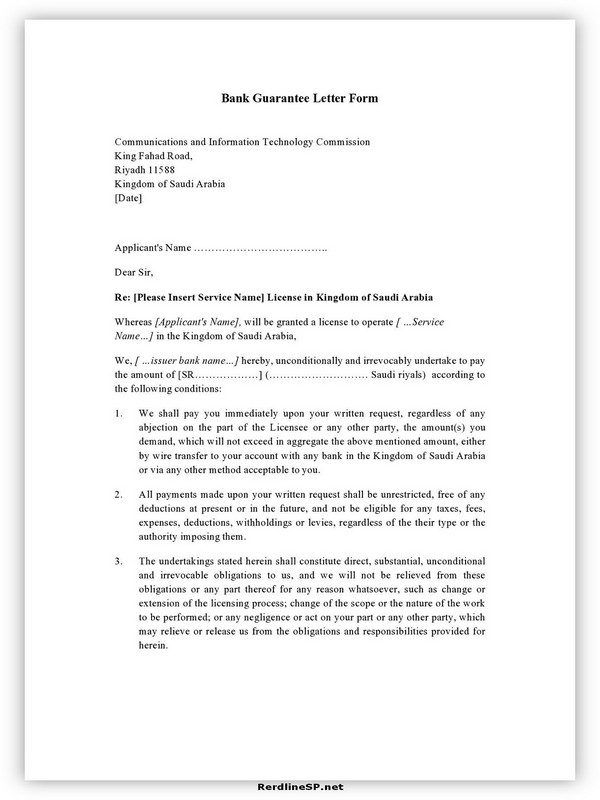

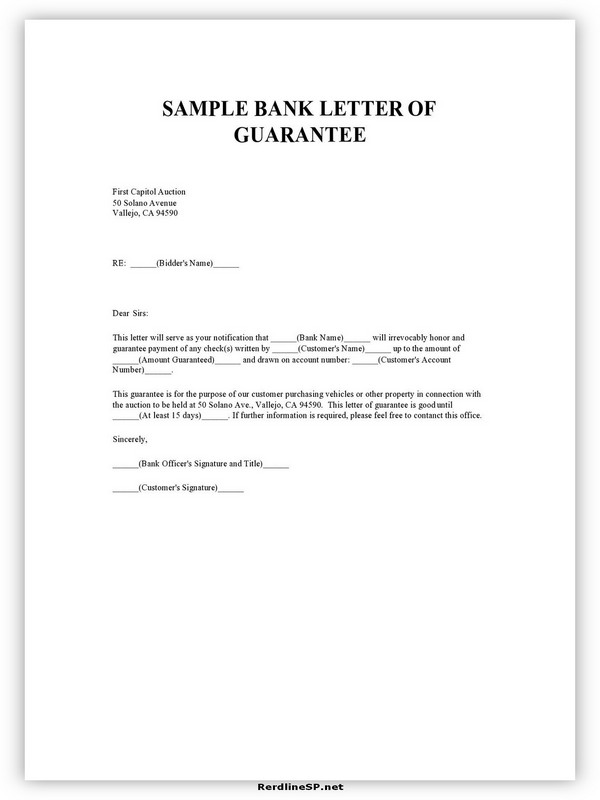

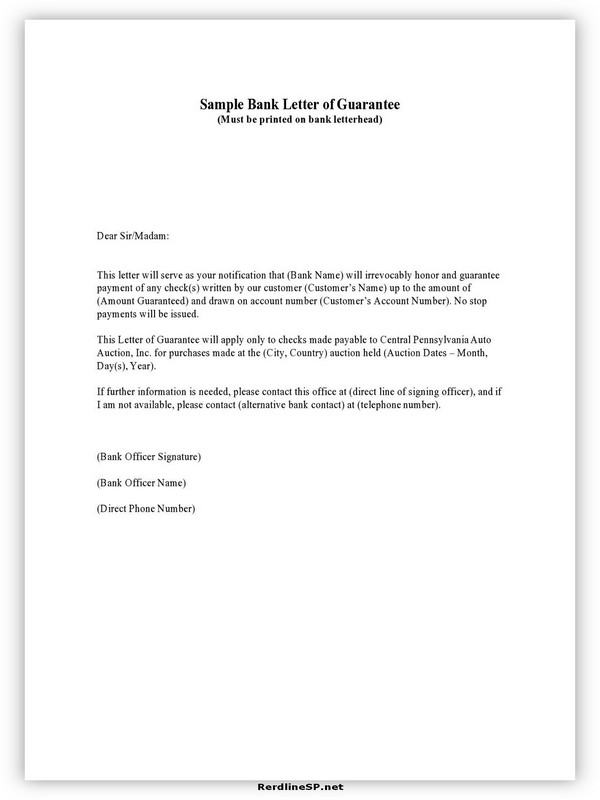

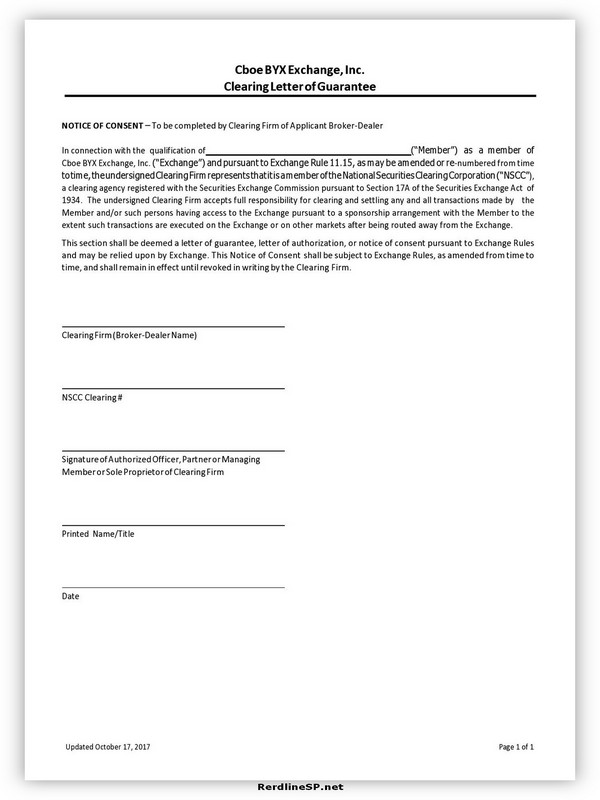

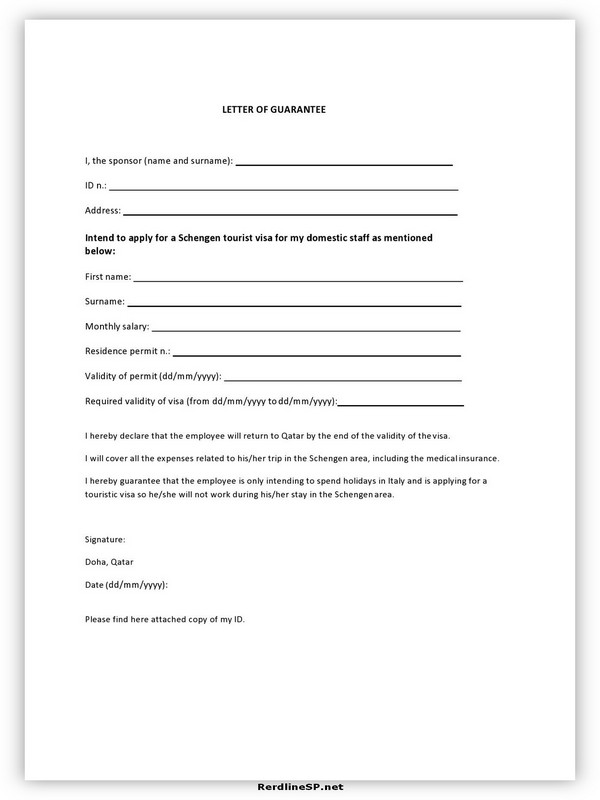

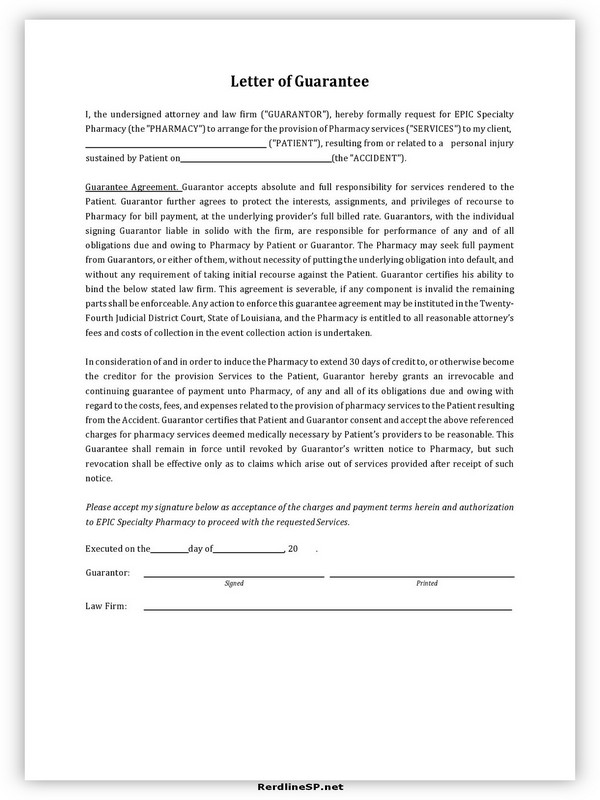

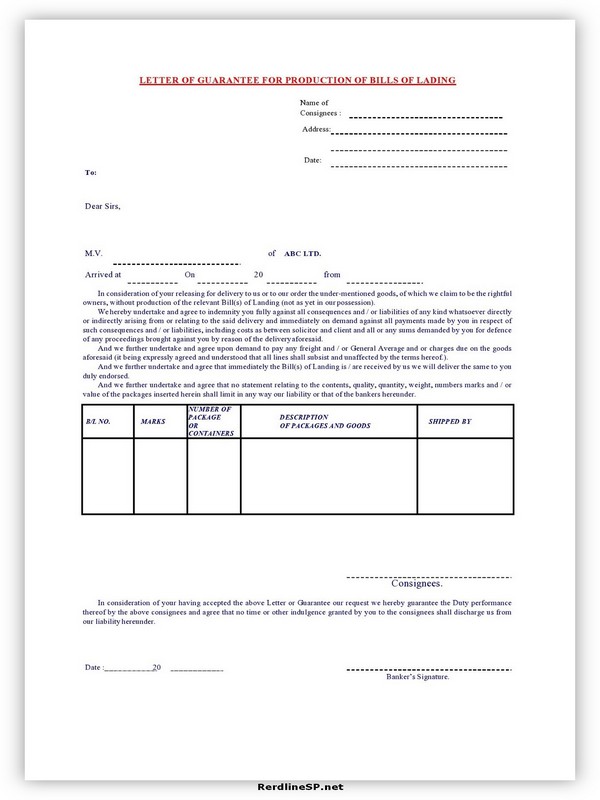

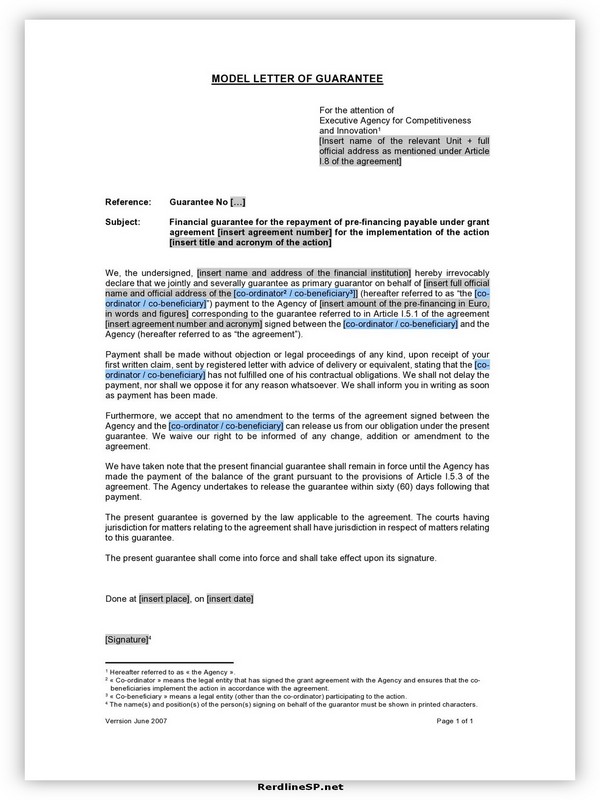

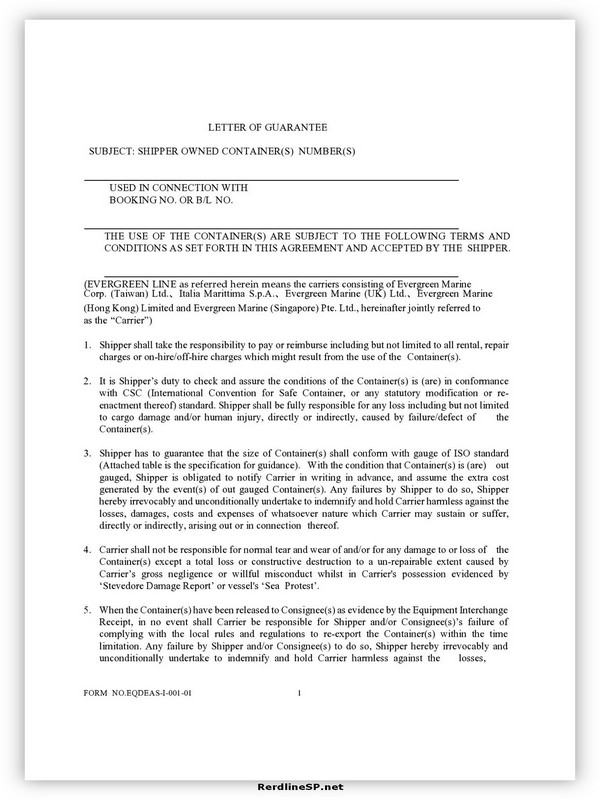

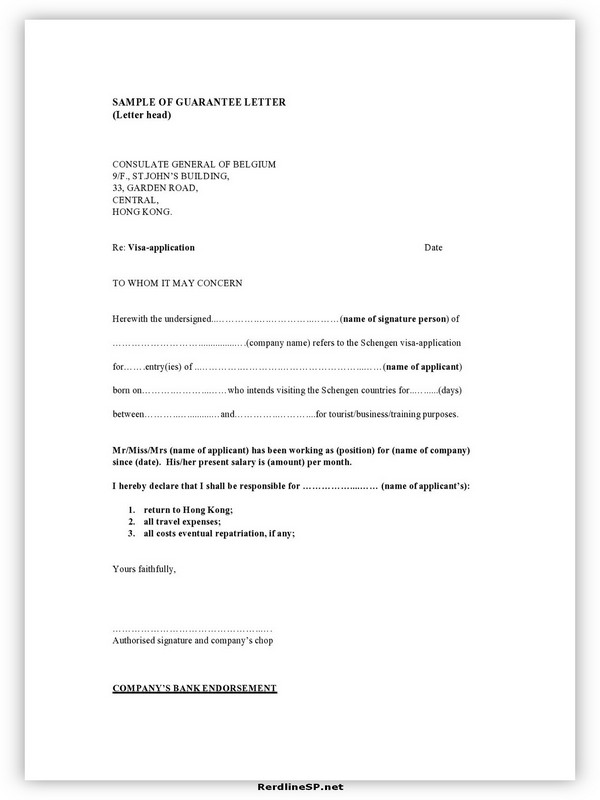

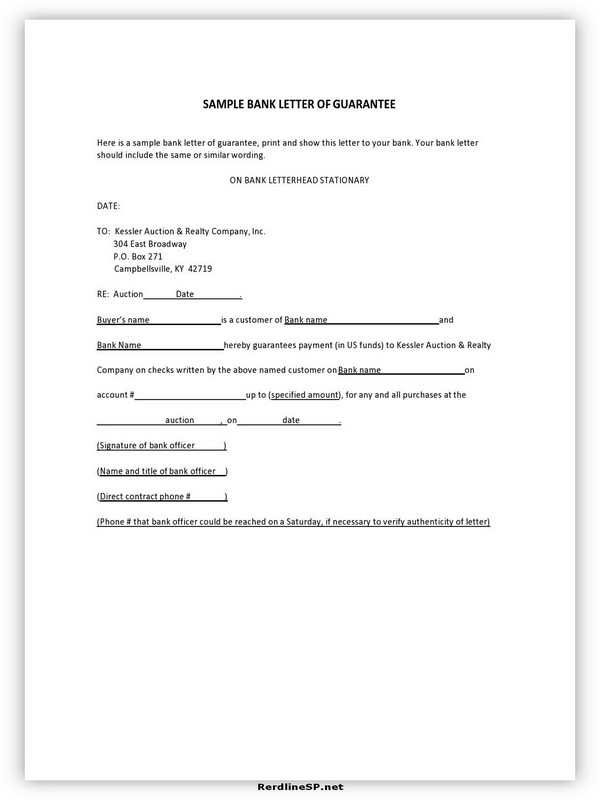

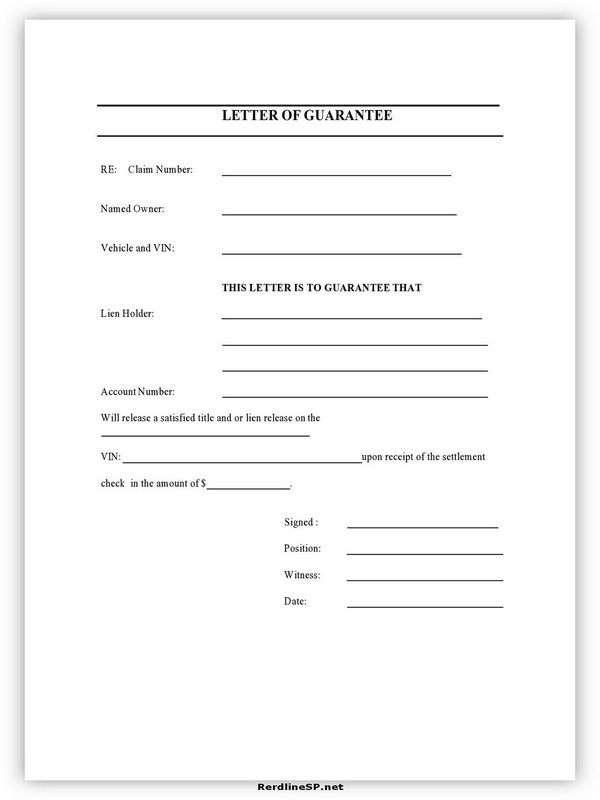

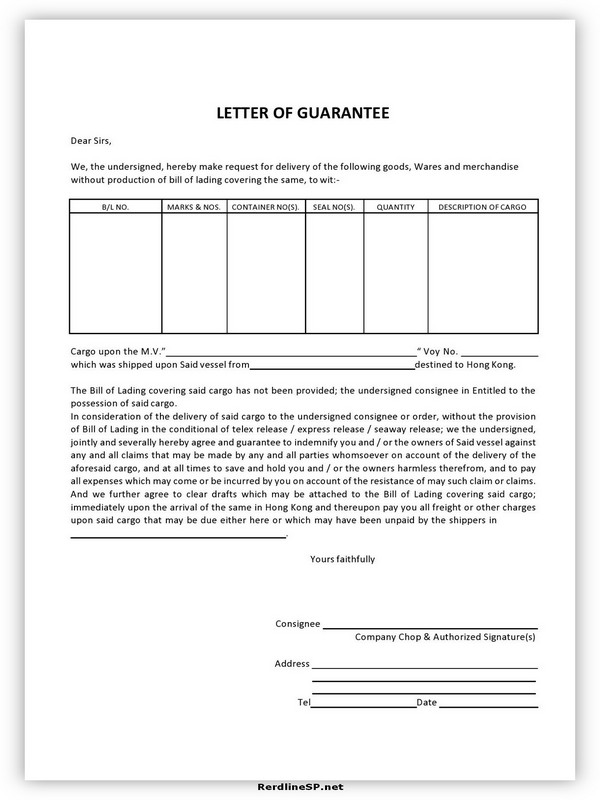

Letter of Guarantee Sample

When is a Letter of Guarantee required?

- New provider

Customers will regularly offer backup letters to new providers, as new providers now have no history of transactions with buyers and as a result, there is great uncertainty between the two parties. This exercise is not uncommon while customers want to buy expensive machines and equipment, and providers do not have to give trade credits alternative trade credit is billing or information between retailers involved in the company with others, which allows modification of products and offers.

- Company

Early-level organizations may not have sufficient liquidity to fund the purchase of goods, and they will ask financial institutions to offer a warrant when purchasing such goods. Even if they now don’t have a credit rating with the provider, it won’t be possible for merchants to choose employer solvency.

- Dealing with providers outside the usual trading areas

Companies that conduct commercial companies where foreign premises may be required to place security letters with the help of vendors who expose their obligations to pay for products. This is due to the fact that providers can incur additional charges when sending goods out the door and that they need assurances from banks that they will receive bills if customers do not pay.

The process of issuing a letter of guarantee

Organizations can also request a delivery letter from a bank if the seller requests a request or isn’t sure if the company can pay for the ordered goods. The Bank follows the following procedure when issuing a letter of guarantee.

- Examination and issuance of letter of guarantee

When a financial institution receives software for a security letter, it must determine whether the consumer qualifies for the same thing or not. This is done by reviewing the underlying transaction, transaction history, and other related materials. Financial institutions may, upon request, also request additional statistics or documents from customers.

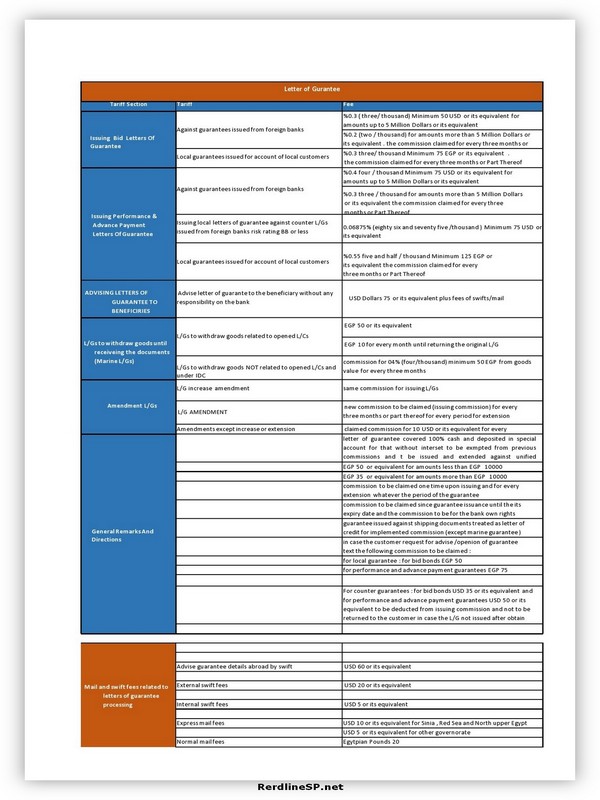

- Cost

Fees must be determined in accordance with the standards and costs set out in the guidelines of the issuing financial institution.

- Letter of assure modification

Before the bank has a problem with the letter of guarantee template, it can be changed if requested by the buyer or recipient.

- Compensation for a letter of guarantee

Once the dealer has delivered the product to the customer and confirmed the payment claim from a secure bank within the validity period, the financial institution must inform the customer of the request. The bank will then examine the declaratory authority and state that they comply with the confirmation letter claim clause. When the financial institution is satisfied with the explanation, it makes an invoice to the trader for an amount equal to the amount of work done.

- Post-Management

After a financial institution makes a payment to a merchant, it updates customer data to reflect the changes that occurred. Financial institutions also keep Akskat and check if they reflect real transactions. After confirming the convenience of the letter of guarantee, the bank revokes the security and recovers the line of credit from the buyer, or if there is a surplus, it returns the money to the consumer.

Letter of Guarantee Template

Example Letter of Guarantee

Let’s say ABC Company is a metal manufacturer and supplier within the Kingdom of California. XYZ, a construction company, is a regular consumer of ABC and has landed a new contract for the construction of the Cyprus City Project, which is expected to cost $6. eight billion. The XYZ agency has asked ABC to give $500 million worth of steel to them in Cyprus, Europe, online on the development website. However, given that Europe is not a neighbor to the ABC’s trade locations, it wants XYZ to send them security letters earlier than at the beginning of the agreement.

XYZ M&N Bank techniques to provide a letter of guarantee so that traders can start providing materials on the website. The financial institution confirmed whether XYZ was eligible for a warrant, and as soon as it was happy, it continued to issue $500 million in legal files with a validity of 180 days to the ABC Company. After receiving a letter of guarantee, ABC sent the metal to a development website in Cyprus. If XYZ does not pay the metal, ABC has the appropriate option to demand repayment from M&N Bank within 180 days for an amount equal to the fee indicated in the security letter.

Letter of Guarantee vs. Letter of Credit

Accreditations and letters of guarantee have a variety of similarities, but they are different things. The letter of credit, also known as a documentary loan, acts as a change in sola financial organization and represents the responsibility of the bank to make payments as soon as positive conditions are met.

After the financial institution confirmed that the terms had been completed and validated, it transferred the money to the executor of the phrase. The credit letter is sponsored by the customer’s collateral or loan.

On the other hand, the warrant is like an accelerator, but with a difference – it pays the seller or buyer if the alternative does not meet the needs of the transaction. If, for example, the dealer. B asks the buyer for a letter of guarantee, but the buyer by default by invoice, the seller has the right to claim damages from the financial institution.

If the consumer is obliged to pay the cargo in advance of the carriage and has requested a letter of guarantee sample to the seller, the customer may also declare payment from the issuing bank if the goods paid for payment are not imported.