Travel expense reports are digital files containing all information relevant to travel-related expenses, consisting of the number of purchases, dates, and course classes. Genuine receipts are usually also included in T&E reviews so, if a tax claim is ever reviewed, the company can provide proof of reimbursement costs.

The global travel industry for commercial companies is worth about $1.28 trillion, with the U.S. contributing to spending some third of that amount. No matter where your commercially available company is located, travel possibilities are one of your 3 biggest gifts, with salaries and SaaS also at the top.

All these spending methods are important for music where this money is spent, and why. In this guide, we’ll walk you through how to file your Business Trip costs and how to optimize your travel expense report.

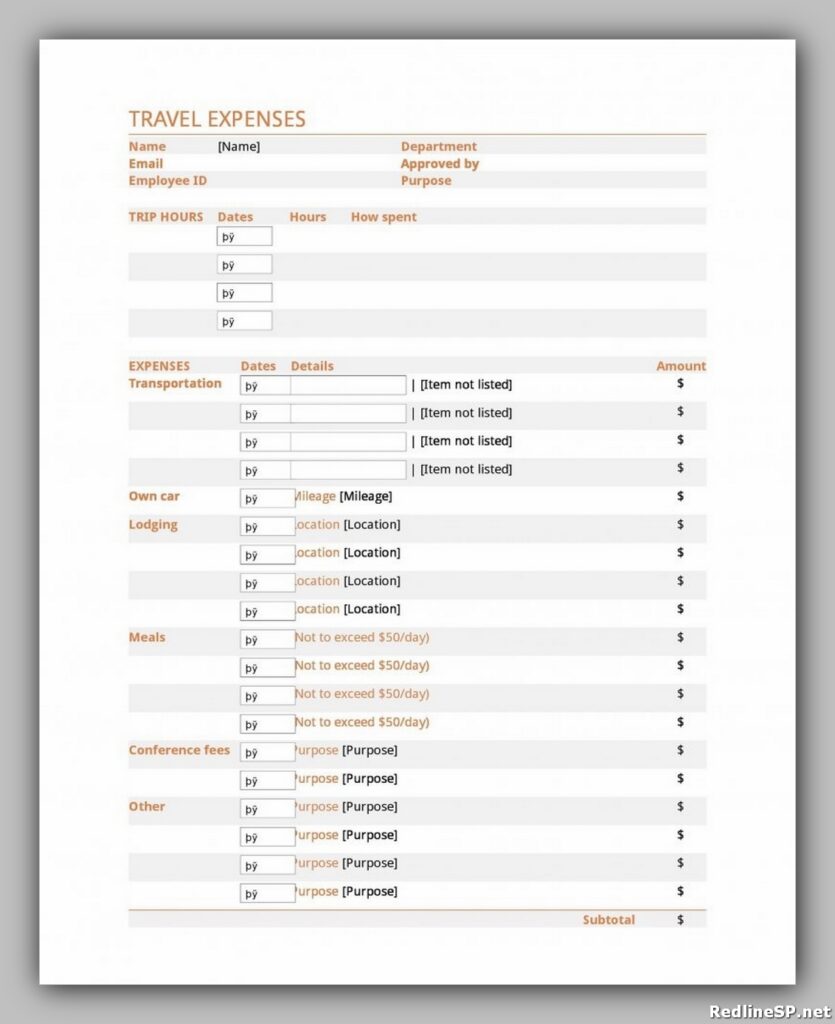

Elements of the Travel Expense Report:

- Date

- Seller purchased from

- Expense categories

- (consisting of customers, companies, accounts, or departments)

- Name of the employee who purchased the item

- Any additional information on how to purchase

- Purchase subtotals

- Tax or VAT in connection with the purchase

- Grand Total (including tax)

- PDF, JPG, or PNG entries for receipts or invoices

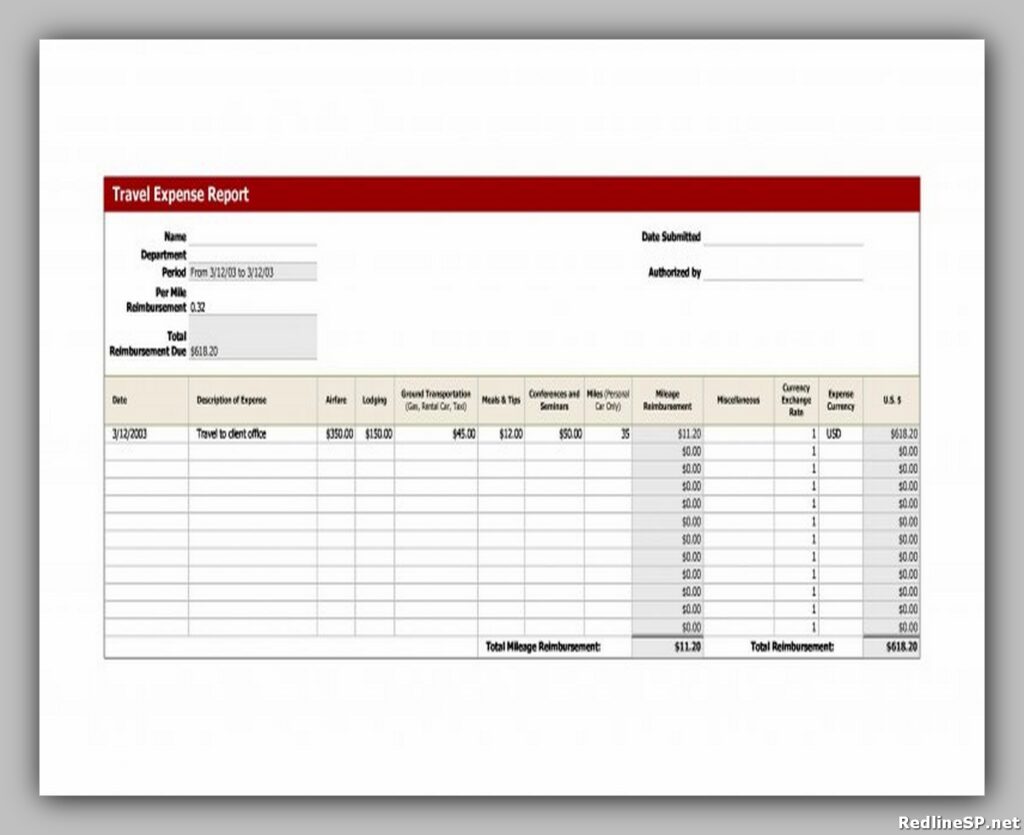

Travel Expense Report

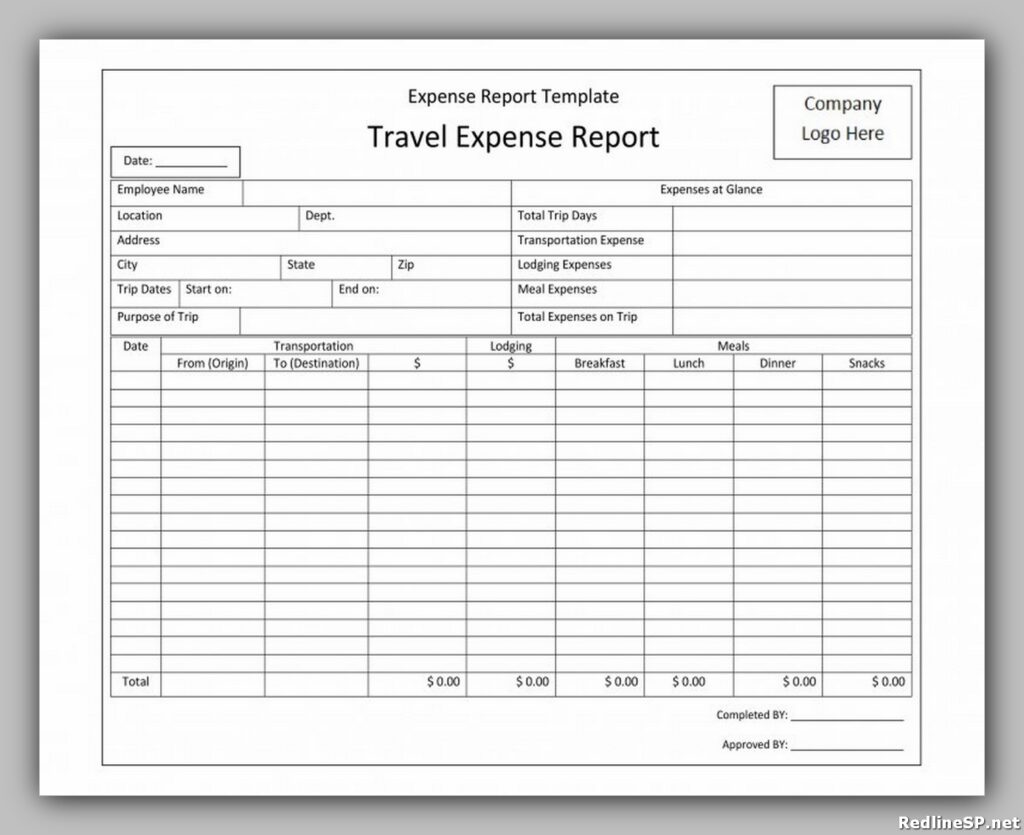

Travel Expense Report Template

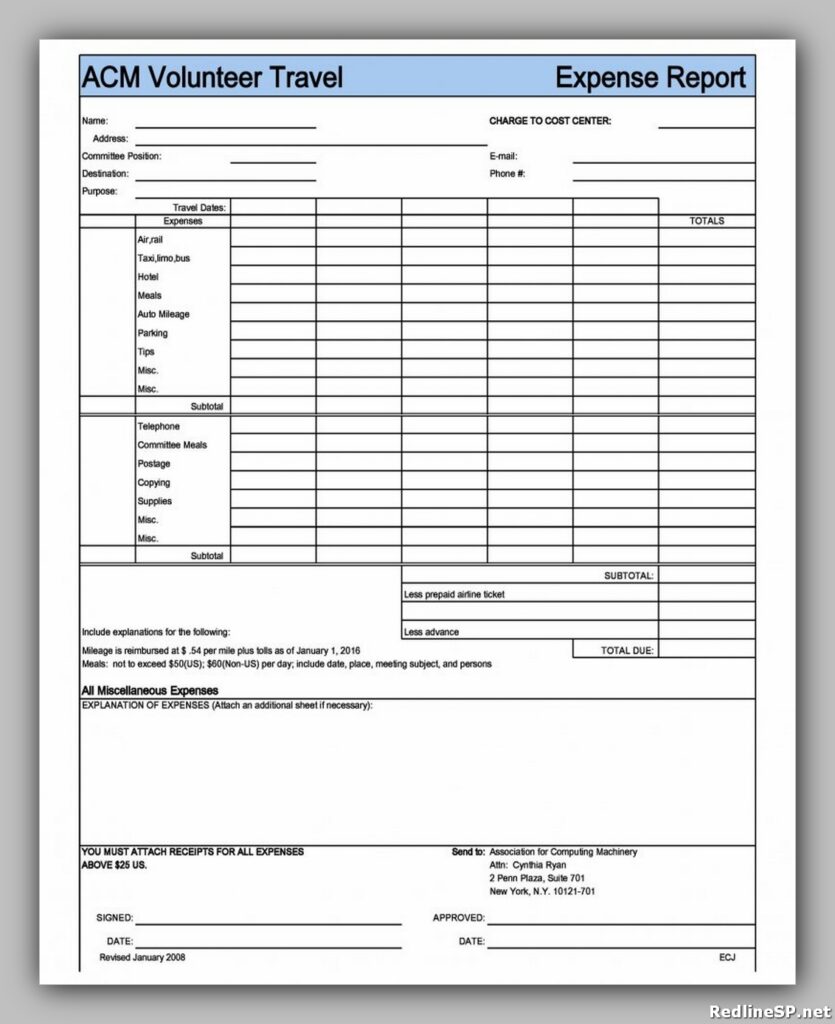

Travel Expense Report Form

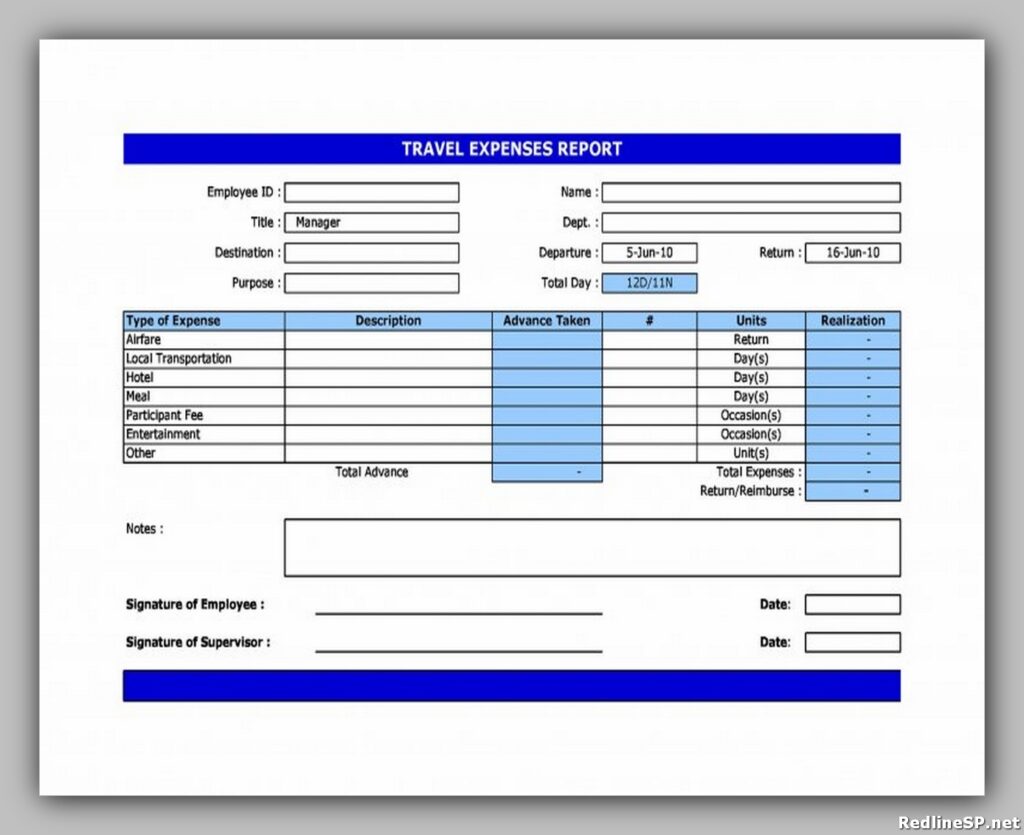

Travel Expense Report Sample

Travel Expense Report Format

Why is Travel Expense Report so important?

Travel expense reports are essential for some important motives that apply to companies, regardless of whether it’s a global organization or a small commercial enterprise.

Steuerausbildung

In maximum international locations around the industry, traveling is completely deductible because it has a legitimate corporate motive. These motives can be professional development, recruitment, revenue, procurement, online customer service on the site, and more. But to legally deduct your costs from the IRS or other government agencies, you will need proof in the form of a receipt or invoice.

Business Intelligence

Reporting isn’t just for government control units where you operate international locations. Understanding travel expense report is critical to your commercial business. For example, if you get . B you about travel expenses, you can make the current decision to stick to your expense range. And with monthly and quarterly reviews, you can identify initiatives or teams that can oversend.

Fight fraud

Unfortunately, reimbursement of travel costs concerns worker fraud. With the right techniques (along with the requirements for linking receipts), you can reduce your risk of business fraud.

Best practices for tracking and Reporting Travel Expenses

In 2021 and in the past, traveling documents and expenses are no longer a physical form. Expense reports should be virtual and integrated into your Enterprise Travel software.

Here’s the ability to optimize your Q&E ranking by receiving scans, consolidating invoices, and withdrawing refund requests. Look at these things and don’t:

Implementing the right software

- Use software programs with automation capabilities: Use a tariff control software program that allows receiving scans to import records of cost file forms robotically.

- DO NOT collect invoices and T&E ratings manually: Forget about paper expense statement templates. This will be the easiest destination to guide the work to your trivialises and directors. Instead, your cost coverage should detail how to use your expense monitoring software.

Book a trip to a region

- Book commercial corporate travel with a travel management platform: Encouraging employees to book in authorized corporate travel management software will allow you to better control their expenses and consolidate expenses into monthly bills. This reduces the need for cost reporting.

- DO NOT eBook Enterprise Travel on Customer’s Website: If your employees book a trip on a consumer website (used by travelers), then your commercial business costs are spread all over the place and require an expense review.

Integrate your technology

- Combine your travel control platform with a cost control platform: You can combine your business travel platform with your cost control platform so that every deductible travel cost is in one place.

- Don’t rely entirely on cost control platforms: while a fare management platform is important for all types of pricing, it doesn’t really help you spend cash. It just shows you what you’ve spent according to reality. You need a commercial enterprise travel platform for pinnable rules and invoice consolidation.

Use company play cards to your advantage

- Provide business credit cards to regular tourists: Several businesses still require staff members to create travel expense report, even if they use their company cards, so it doesn’t look like a time-saving company card. But it’s not. The modern rate management structure matches the cost check with credit card transactions, so your financial group doesn’t have to.

- It doesn’t require travelers to keep demanding refunds: employees don’t have to pay with their own money, after which to fill out refunds. With a corporate card, there is no desire. If you have fewer refund forms, you’ll save time for travelers and administrators.

Digitize your travel policy

- Do consist of your T&E coverage on your Travel Control machine: One of the reasons why the company’s travel platform is so important is the potential to digitize regulations. These policies impact the search and booking experience, so they actually manage travel expense reports.

- DON’T rely on cover notes to help you control expenses: Employees fail to check policy files. If your T&E coverage is most numerous in the data set, it may be able to educate staff in how to experiment with receipts, but accept spending controls in the second, which is clearly submissive.

A smart strategy to save money on travel expenses

How to streamline your travel and expense accounting is just one piece of the puzzle. You may also want to reduce travel costs for commercial companies.

Analyze travel costs with the help of people, groups, projects, and more.

Use your business travel software program to set up tags, classes, and cost amenities. This allows you to adequately calculate the ROI of your company’s travels and set a higher budget for the future.

Monitor journey canceling and recoverable VAT for value optimization

TravelPerk allows you to request travel cancellations and refundable VAT. If you find a high number of cancellation experiences (due to uncontrollable circumstances), you may choose a bendy and refundable travel instead. You can also read all the information needed to reclaim VAT.

Create custom travel rules for specific groups or projects

The better your travel policies suit your business, the higher they will work. Set specific rules for specific travel reasons (along with recruitment) or for different groups (. B income).

Use dynamic travel budgets for accuracy of coverage in each city

It is not possible to set the right hotel budget per night if your company travels to several cities. Travel Perk allows you to set dynamic budgets that allow your staff to spend a higher positive percentage of the cheapest options available.

By digitizing the travel expense reports as part of your travel control approach, you save time for everyone with your employer while gathering the latest valuable facts. And when you travel an eBook using travel management software, consolidate your provider so travelers don’t even have to create reviews for those bookings.